Dual strikes disrupt Germany's travel sector amid troubled economy

Strike actions have engulfed Germany and crippled its economy, causing extensive disruptions for millions, as both train operators and airport staff have gone on strike amid a looming recession.

The leading economy in Europe has been facing challenges due to ongoing industrial disputes for several months, with employees and employers in various industries struggling to reach agreements amidst soaring inflation, high cost of living, and a sluggish business performance.

On Thursday, millions had to make alternative travel plans, after a 35-hour loco pilots’ walkout coincided with a two-day strike by Germany's national carrier Lufthansa Airline’s ground staff, crippling the country’s travel sector.

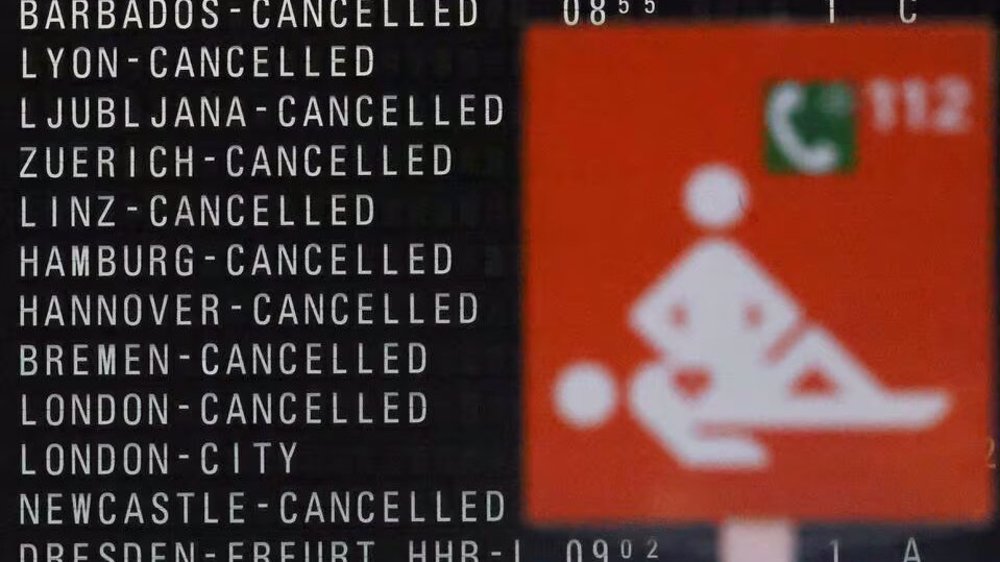

The latest mass industrial action led to passenger strands at platforms and airports and mass flight cancellations at Germany’s busiest airports, including main hub Frankfurt.

At 0100 GMT, engine men initiated their fifth round of strikes in an ongoing dispute over pay and working conditions, following a walkout in the cargo division that commenced on Wednesday evening.

Claus Weselsky, head of the German train drivers’ union (GDL) told reporters, “With this, we begin a so-called strike wave.”

GDL demands that national train operator Deutsche Bahn reduce workers’ weekly hours from 38 to 35 hours at full pay to help offset lofty inflation and staff shortages.

"The motivation is high to follow through with the conditions that we have set as GDL members," said train driver Philipp Grams at the picket line in Cologne.

Deutsche Bahn said it expected "massive disruptions" on Thursday and Friday.

The rail operator has accused the union of refusing to compromise. Its spokesperson, Achim Stauss said: "The other side doesn't budge a millimeter from its maximum position."

A one-day nationwide rail strike costs around $107 million in economic output, Michael Groemling, head of economic affairs at IW Koeln, told Reuters during GDL's last strike in late January.

"I don't like it much, but if it makes a difference, if people want to change something, why not?" said Katerina Stepanenko, standing on the platform at Cologne's main station.

"Enough is enough. It's a big nuisance and I can't quite understand whether the demands, some of which are certainly justified, have to be enforced with such harsh means," stranded train passenger, Walter Roehrer told APTN News in Berlin.

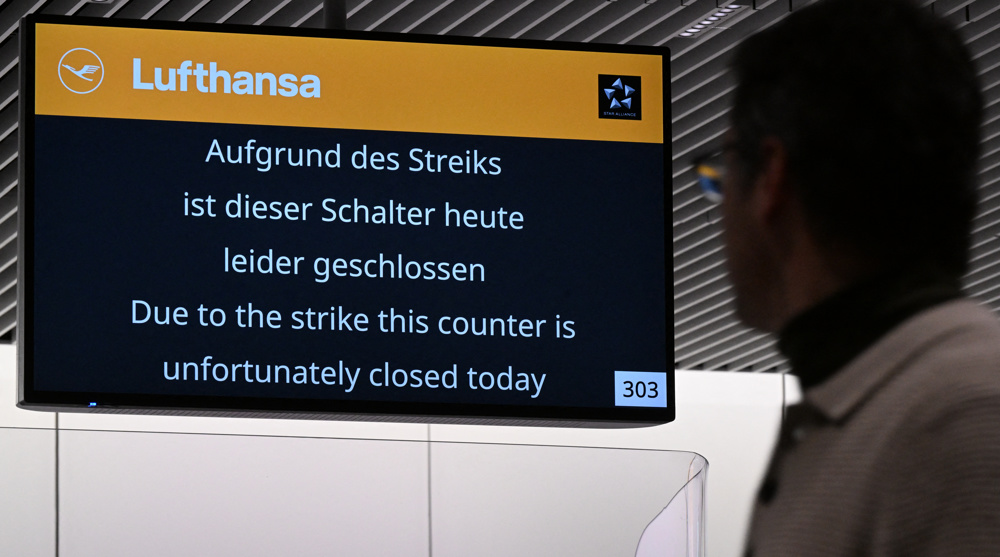

Meanwhile, in air travel, Lufthansa ground staff held a nationwide strike from 0300 GMT on Thursday as the action is due to last until 0610 GMT on Saturday.

The Verdi union, which represents some 25,000 airline ground staff, is demanding a 12.5% pay rise or at least $547 more per month, along with an inflation compensation bonus of $3,283.

Lufthansa has offered inflation compensation bonus over a period of 28 months along with a 10% more pay, which is not enough to meet Verdi's demands.

The airline has warned that the strikes were a factor that would lead to a higher-than-expected operating loss in the first three months of 2024.

Frankfurt airport’s operator, Fraport announced that it had to cancel its planned departures because of the ongoing strike.

“Fraport is asking all passengers starting their journey in Frankfurt not to come to the airport on March 7 and to contact their airline,” Fraport said in a statement on Wednesday.

The ADV airport association, on the other hand, cautioned that the recent strikes in the aviation industry, occurring in Hamburg, Duesseldorf, and Frankfurt, were detrimental to Germany's image as a hub for business and tourism.

The German airliner also revealed on Thursday that its earnings had increased twofold in 2023, from $866 million in 2022 to $1.82 billion, due to the surge in demand following the recovery in the industry post the COVID-19 pandemic.

The costs of such strikes have been cautioned by the industry, following a 0.3% contraction in 2023 of the German economy, making it the world's worst-performing major economy, and the government's warning of a recovery that is weaker than anticipated.

The German government expects the economy to grow 0.2% this year, far less than a previously forecast 1.3% and is broadly expected to enter another technical recession by the first quarter of this year.

What led to dilly-dallying in ICC arrest warrants against Netanyahu, Gallant

Palestinians flee Gaza City suburb after Israel issues forced evacuation order

Iran says will discuss key nuclear, regional issues with France, Germany, UK

VIDEO | Israeli archaeologist killed in Southern Lebanon

VIDEO | Israeli airstrike on Lebanon's army base kills soldier, injures 18 others

Sirens sound across Tel Aviv as Hezbollah fires barrage of missiles at Israeli target

Israeli ‘archeologist’ who toured south Lebanon in military uniform to falsify history

The importance of Venezuela for Iran

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website