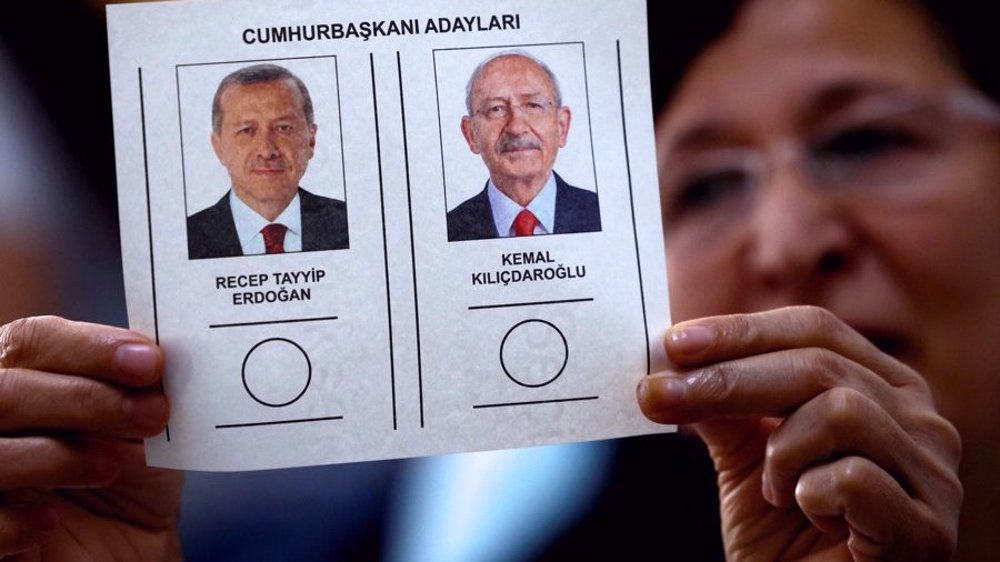

Turkey's Lira sinks to fresh record low after Erdogan re-elected

The Turkish lira has sunk to a record low after long-time leader Recep Tayyip Erdogan secured his victory in the 2023 presidential election, saving his place at the helm for a new term in office.

The lira sank to a fresh record low on Monday, briefly touching 20.0608 against the dollar, due to a negative outlook about the incumbent’s economic policy.

Refinitiv data showed five-year CDS were trading at around 664.18 basis points, marking a 20 percent climb from the 550 basis point level prior to the Turkish run-offs.

Financial markets analysts link the currency's decline to Ankara's continuation of low-interest rates, restrictive foreign currency regulations, and high inflation.

“We have a pretty pessimistic outlook on the Turkish lira as a result of Erdogan retaining office after the election,” Wells Fargo’s Emerging Markets Economist and FX Strategist Brendan McKenna told CNBC’s “Squawk Box Asia.”

The markets economist and FX strategist predicts that the lira will reach a new record low of 23 against the dollar by the end of the second quarter, and then 25 as early as next year.

McKenna forecasts Turkey’s lira to continue to lose value as long as Erdogan's government continues to implement the same monetary and economic policies of past years.

Over the last five years, the Turkish lira has lost some 77 percent of its value against the dollar as Ankara pursued economic growth and export competition rather than controlling inflation.

At the same time, Erdogan opposes any increase in interest rates, pushing the view that raising interest rates increases inflation.

Analysts say that Ankara's currency policy is contrary to the principles governing a stable market.

“The current set up is just not sustainable,” said BlueBay Asset Management’s Senior EM Sovereign Strategist Timothy Ash via email. “With limited FX reserves and massively negative real interest rates the pressure on the lira is heavy.”

International market analysts warn that the combination of low interest rates and soaring inflation leads to a bleak outlook.

“If the Lira continues to plunge and inflation surges again due to the policy of inappropriately-low interest rates, we could see a repeat of the ‘flight to safety’ allocation to Turkish equities by local investors which moved the market sharply higher in 2022,” MarketVector’s CEO Steven Schoenfeld wrote in an e-mail.

According to Wells Fargo’s McKenna, "It’s a very bleak economic and markets outlook for Turkey.”

Kilicdaroglu, who had promised to fix Turkey’s faltering economy and restore democratic institutions compromised under Erdogan’s leadership, said the president's political party had mobilized all the means of the state against him in the "most unfair election".

Erdogan won the presidential race with just over 52 percent of the vote while Kilicdaroglu bagged nearly 48 percent of the ballots. He has said that controlling inflation is now the most important issue he wants to address urgently.

"If they continue with low interest rates, as Erdogan has signaled, the only other option is stricter capital controls," warns Selva Demiralp, professor of economics at Koc University in Istanbul.

Leader: Iran has no proxy forces in West Asia

US fighter aircraft shot down ‘in friendly fire’ amid aggression on Yemen

Yemeni FM: Israel’s sponsors accountable for ongoing aggression on Sana’a

Eight Palestinians killed as Israel attacks Gaza school, hospitals

VIDEO | Rome, Milan host new protests in solidarity with Palestinians

Dec. 21: ‘Axis of Resistance’ operations against Israeli occupation

Spain jurists demand ties with Israel ties be cut

VIDEO | Press TV's news headlines

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website