Turkish lira falls to record low amid prospect of Erdogan re-election

Turkey's lira has weakened to another record low on prospect of President Recep Tayyip Erdogan's re-election in the runoff vote on May 28.

The lira plunged to 19.70 against the dollar while stocks tumbled as Turkey’s benchmark BIST-100 index sank as much as 6.4 percent in premarket trade after Sunday’s election, in which Erdogan performed better than opposition leader Kemal Kilicdaroglu.

The presidential election, however, is heading to a historic run-off now as neither of them claimed an absolute victory.

“An opposition victory looks to have become less likely and this will disappoint investors hoping for a return to orthodox economic policymaking and a more credible commitment to tackling Turkey’s inflation problem,” Liam Peach, senior emerging markets economist at Capital Economics, said.

He emphasized, “We think the continuation of low-interest rates, restrictive foreign currency regulations, and high inflation could increase the threat [of] a severe currency crisis down the line.”

Following the first round of results, the Istanbul bourse benchmark (.XU100) fell 6.1 percent, its largest daily percentage drop since early February, and its banking sub-index fell by 9.2 percent at the close of business.

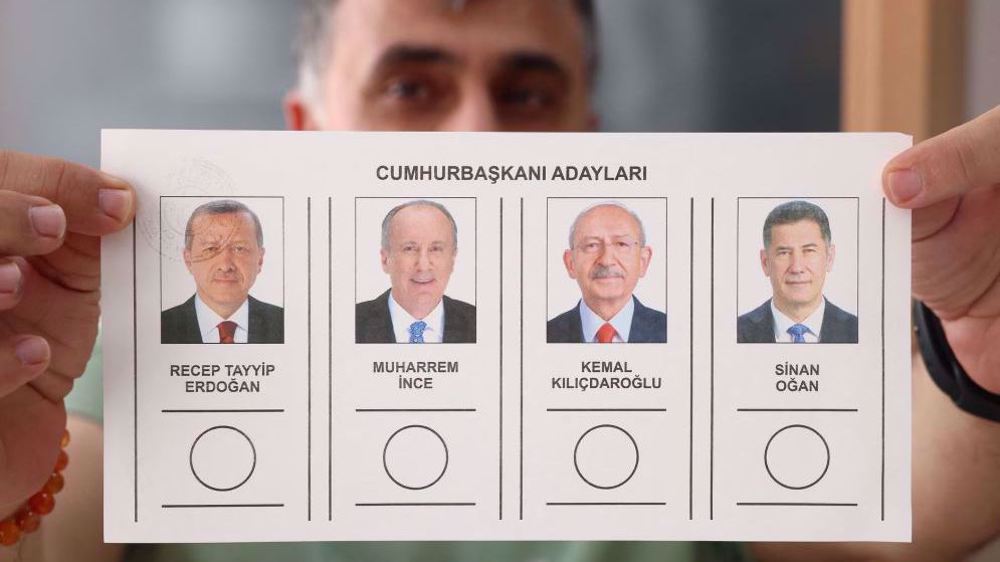

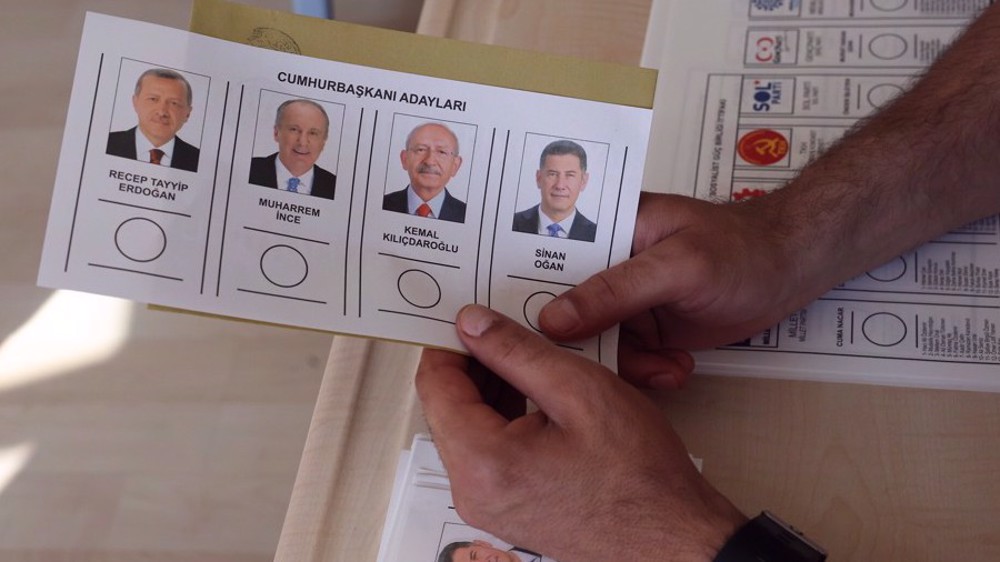

The Turkish Stock Exchange was forced to stop trading for a brief period of time by the severe drop in share prices as results confirmed opposition leader Kilicdaroglu had claimed 44.96 percent of votes in the Sunday presidential election. Incumbent President Erdogan received 49.51% of the vote.

Financial experts had hoped Kilicdaroglu would be able to win Erdogan and return to orthodox economic policies.

Financial experts have noted the instability has made investors in Turkish government bonds worrying the country’s capacity to pay them back.

According to data from SandP Global Market Intelligence, the price of purchasing insurance against the risk of a government default, also known as a credit default swap, increased by almost 27 percent, marking its highest level since November.

According to data from the Turkish Statistical Institute, annual consumer price inflation jumped to 85 percent in October before falling to 44 percent in April.

Kilicdaroglu has promised to fix Turkey’s faltering economy and restore democratic institutions compromised under Erdogan’s rule.

“A victory for President Erdogan, which now looks like the base case scenario… would be negative for Turkey’s macroeconomic stability and financial markets,” Peach added.

“We think the continuation of low interest rates, restrictive foreign currency regulations and high inflation could increase the threat [of] a severe currency crisis down the line.”

The presidential election poses the biggest challenge to 69-year-old Erdogan, amid an economic downturn and the impact of the devastating February 6 earthquake.

A victory for President Erdogan, which now looks like the base case scenario… would be negative for Turkey’s macroeconomic stability and financial markets, Peach was quoted as saying by CNN.

“We think the continuation of low interest rates, restrictive foreign currency regulations and high inflation could increase the threat [of] a severe currency crisis down the line.”

5 Israeli forces killed as Palestinian fighters face up to regime’s war machine

VIDEO | Israeli settler killed during strike against Tel Aviv; fresh aggression targets Yemen’s capital

VIDEO | Yemen’s missile strikes on Tel Aviv

Iran to open 6 GW of new power capacity by next summer

VIDEO | South Korean rallies set the stage for battle over Yoon's impeachment

Hamas, other Palestinian groups say Gaza ceasefire deal ‘closer than ever’

VIDEO | Press TV's news headlines

Iran condemns ‘violent’ attack on Christmas market in Germany

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website