China decries implementation of discriminatory US stock exchange law

China has decried the implementation of a law in the United States that could delist Chinese companies from American stock exchanges.

The US Securities and Exchange Commission (SEC) began implementing a law called the Holding Foreign Companies Accountable Act that is aimed at removing Chinese companies from US exchanges if they run foul of certain American auditing rules for three years in a row.

The SEC said in a statement on Wednesday that the law required firms to prove that they are not owned or controlled by an entity of a foreign government.

The rule also requires Chinese firms to name any board members who are Chinese Communist Party officials.

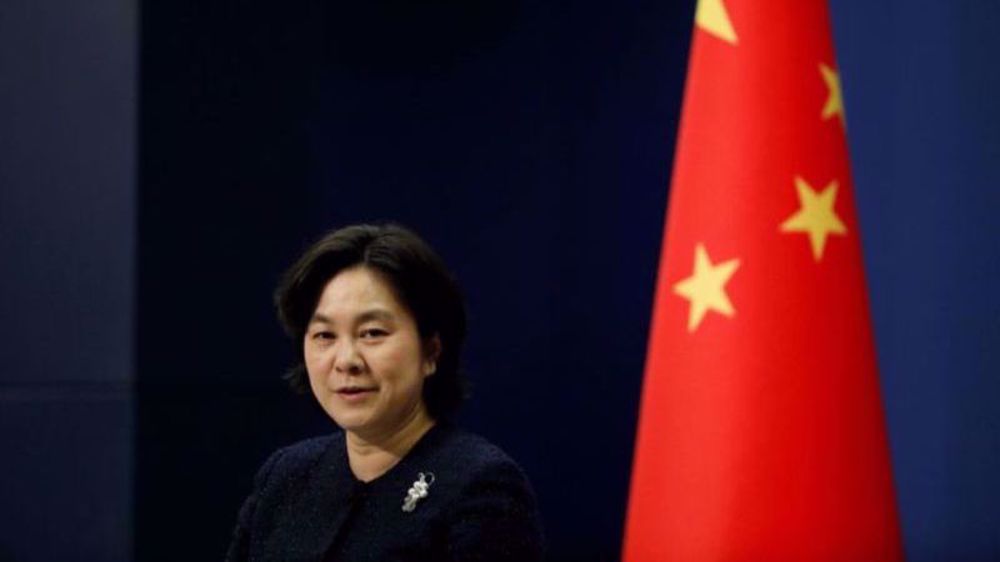

China’s Foreign Ministry spokeswoman Hua Chunying said on Thursday that the US measure distorted market principles.

Beijing also urged Washington to stop "discriminatory" action against Chinese firms.

The law was approved by the administration of former US President Donald Trump in December last year.

The United States’ relations with China grew increasingly tense under Trump. Washington clashed with Beijing over trade, the South China Sea, Taiwan, Hong Kong, and the coronavirus pandemic. Former US secretary of state Mike Pompeo even openly called for regime change in China.

Later, President Joe Biden backed Trump’s tough approach toward China, saying that the US would continue to confront what he called China’s "attack on human rights, intellectual property and global governance," rhetoric that is used when countries do not serve US interests.

Beijing has rejected those charges.

China raises retaliatory tariffs on US goods to 125%

China's oil imports from Iran surge despite US sanctions: Report

Xi calls on EU to join China to resist Trump trade war 'bullying'

Many wounded civilians die under Gaza rubble due to lack of equipment: Civil Defense

'Ugliest form of genocide': Palestine condemns Israel's attack on Gaza hospital

VIDEO | Press TV's news headlines

VIDEO | Israel renders the only operating hospital in Gaza out-of-service.

Leader: Ill-wishers furious with Iran’s increasing advances

Jeffrey Sachs: West Asia will see no peace until US is out

The implications of Trump’s trade war for Iran

Iran: Indirect talks with US strictly limited to nuclear, sanctions issues

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website