Economic expectations from Iran’s next government

Iran's economy has been facing many structural problems during the past decades, where the lack of appropriate policies has led to the accumulation of problems and various economic super-challenges.

However, minimal oil resources have made the administration of the country somehow possible during all these years, disallowing the problems and super-challenges to take a serious external manifestation.

Nevertheless, Iran’s economic challenges are such that they require financial resources for control and management. The pension fund deficit, state budget deficit, banking imbalance and the need for investment in water and environment all need financial resources in order to mitigate the problems.

In the past years, the decline in foreign exchange resources due to oil sanctions caused Iran's economy to deviate from its normal path, which was regulated by oil revenues, where the performance of the economy was affected by the quality of economic policies to a much greater extent than in the past.

That came as state politicians and also an important part of the country's bureaucratic system appeared not prepared to manage the economy, and therefore, they did not deal appropriately with the situation.

The contraction in foreign exchange resources took place especially under the shadow of economic sanctions, where a raft of rules set to face them led to the formation of certain interest groups and income disparities.

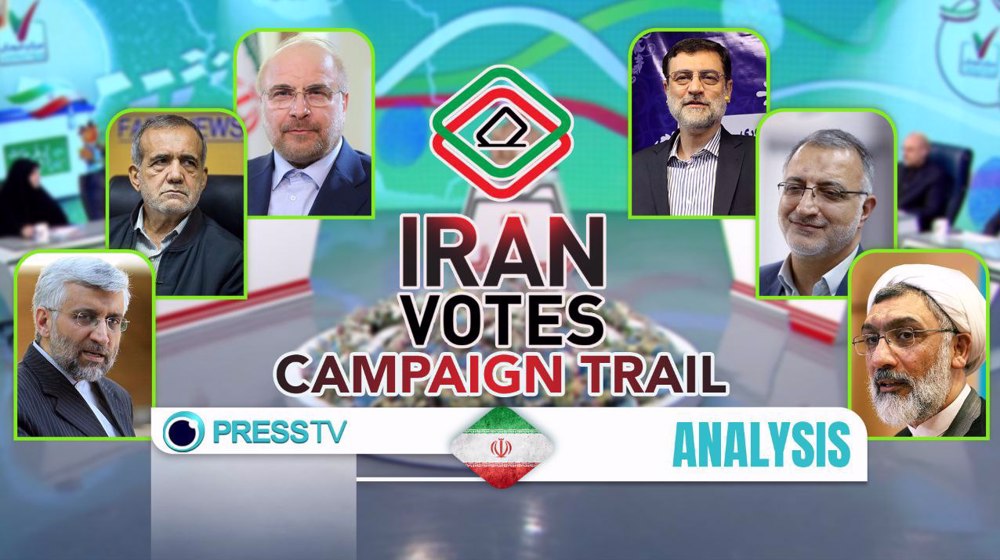

While the outgoing government of late president Ebrahim Raeisi strived to address them, the new government has an important task to pick up the slack and fill the gaps.

According to economists, redressing the wrongs would require policy reform at the highest level, where the country's decision-makers should remove the government from the tutelage of interest groups.

As mentioned, oil revenues have decreased due to the lingering economic sanctions and the government is not able to run the country with petrodollars as in the past.

The good news is we are already learning how to run the country with the money sans oil revenues. This puts the kibosh on the long-held delusion of artificial prosperity and forces us to balance our money, which is said to be the key to having enough.

This means those interest groups cannot play roulette with the tax payer money any longer. State planners, meanwhile, have to abandon their master-servant treatment of the masses and focus on their main duties.

First things first, no economy grows unless the economic policies aimed at it are stable and economic entities are able to predict its main variables.

Currently, Iran’s inflation of above 40% and the difficulty to lower it due to structural obstacles and the influence of stakeholders has destabilized the macroeconomic environment.

The more the economy is close to stability and the business environment is favorable, the more is the motivation for long-term investment and production and creation of added value. On the contrary, the more the economy is caught in the abyss of instability and high inflation, the less is motivation for investment and entrepreneurship.

Currently, high inflation has caused the rate of return from holding assets to be higher than the return from creating added value. In such an environment, the urge to acquire and hold all kinds of assets is stronger than production and entrepreneurship with all its complications.

This leads to the formation of a brokerage system, which has proliferated in recent years, where agents in real estate, currency exchange, precious metals and cars have been cashing on the public frenzy to protect their assets from currency depreciation.

People complain that while institutions in the political structure are not responsible for the irregularities in economic policy and living conditions, their private businesses have countless claimants.

Extensive intervention in the economy and the desire to intensify the multi-price system on the one hand have prevented governments from fulfilling their main duties, i.e. the production and supply of public goods, and on the other hand, it has led to the suppression of incentives in the private sector to produce goods. The outcome is the aggravation of poverty and unemployment of the people.

The new decision makers should realize that the main source of problems is wrong policies.

For years, politicians have approved plans that are apparently designed to support deprived areas and low-income groups, but in practice, they have resulted in the distribution of rent for a few people.

Economists say supporting low-income groups should not come at the cost of ignoring principled and scientific solutions. They say unprincipled ways such as price stabilization and suppression of the market and ownership are not the solution to reduce poverty.

VIDEO | Former FBI agent criticizes US Congress for 'outright corruption'

IRGC chief urges Muslim countries to cut aid routes to Israel

'New chapter in cooperation': Iran, Venezuela sing new MoUs

Jordan sentences former lawmaker for supporting Palestinian resistance

Basij volunteer forces hold massive drills in southwestern Iran

Israeli war criminals 'not welcome', US city says after ICC ruling

US vetoing of Gaza ceasefire resolution ‘disgraceful’: Iran’s UN envoy

VIDEO | IAEA adopts anti-Iran resolution tabled by E3

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website