Iran’s inclusion in BRICS can increase bloc’s influence, challenge dollar: Expert

By Syed Zafar Mehdi

Iran’s induction into the BRICS group of emerging economies can increase the bloc's influence in a crucial region of the world and further challenge the dominance of the Dollar, says an expert.

In an interview with the Press TV website, Chris Hattingh, the Head of Policy Analysis at the Johannesburg-based Centre for Risk Analysis (CRA) said Iran’s entry augurs well for the alliance.

“With Iran forming part of BRICS from 1 January 2024, BRICS can move further along the path of plans such as a currency to challenge the Dollar, or to have access to new sources of energy, such as oil and gas,” he noted, referring to the date when Iran’s full membership of BRICS will come into effect.

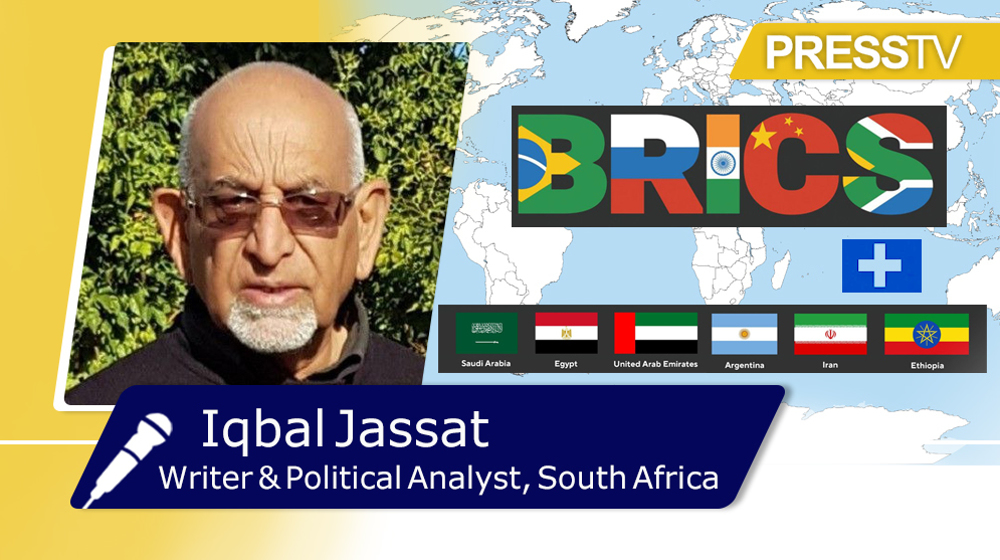

The BRICS group on Thursday announced the admission of six new members, after the five existing members – China, Russia, Brazil, India and South Africa – unanimously approved the bloc’s expansion after years of procrastination.

The six new members who have been invited include the Islamic Republic of Iran, Saudi Arabia, Egypt, Argentina, the UAE and Ethiopia.

South African President, Cyril Ramaphosa, the host of the 15th BRICS summit, said the members agreed on “the guiding principles, standards, criteria and procedures of the BRICS expansion process.”

With the bloc's expansion, the Gross Domestic Product (GDP) of BRICS member countries now accounts for 36 percent of global GDP and 47 percent of the world population.

The Johannesburg Declaration 2 adopted at this year’s summit seeks to spur the development of BRICS member countries and pave way for the more inclusive economic policies for all members.

Hattingh, who is a member of the advisory council of the Initiative for African Trade and Prosperity as well as a senior fellow at African Liberty, said Iran’s important place in West Asia will benefit BRICS.

“Iran's weight, especially in Middle East geopolitics, cannot be underestimated, and in this regard, its addition into BRICS could well increase the influence of BRICS itself in a crucial region of the world economy,” he said in a conversation with the Press TV website.

On BRICS countries ending the dominance of the US Dollar, the South Africa-based analyst said BRICS members “may shift to settling transactions and trade in their own currencies, between each other, but first up could be the wider use and influence of the Chinese yuan.”

“Should the countries that form BRICS pursue policies and agreements that spur economic growth and advancement, their influence will grow,” Hattingh remarked.

“But, if they follow ideas and policies that inhibit freedom and growth, they will not necessarily extend their global influence,” he hastened to add, with a hint of caution.

He said the world is entering “a period of 'multi-alignment' and 'multi-interests’.”

“In terms of economic and technological influence, some countries will remain at the forefront more so than others. Some singular countries could remain the most influential, but relationships between countries could become a bit more nuanced and tricky to navigate,” Hattingh said.

IRGC a thorn in the side of enemies; no power dares to threaten Iran: Analyst

Waqf Bill not just an attack on Indian Muslims but on India’s constitutional fabric: MP

Trump's war rhetoric against Iran to impose heavy costs on US and allies: Analyst

Yemen's president orders nationwide ban on all US products

France detains Iranian journalist amid crackdown on pro-Palestinian voices

VIDEO | Digital censorship amid aggression: Google disables Street View in West Bank

Remembering Sheikh Bahai, Iran's iconic theologian, astronomer, engineering genius

India suspends water treaty with Pakistan after terror attack

Manhunt underway for gunmen in Kashmir attack as death toll rises to 26

VIDEO | Middle East alliances: Where do they stand now?

Iran’s FM warns of Israeli attempts to derail diplomacy through various tactics

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website