India, UAE sign deal to use national currencies in bilateral trade, ditching US dollar

India and the United Arab Emirates (UAE) have signed an agreement to carry out the two countries' bilateral trade in their own national currencies, thus reducing dependence on the US dollar.

The agreement was signed during a visit to the UAE's capital city of Abu Dhabi by India's Prime Minister Narendra Modi on Saturday. The Indian premier was making a stopover in the Emirati capital while returning to his country from a visit to Paris.

يسعدني دائمًا مقابلة صاحب السمو الشيخ محمد بن زايد آل نهيان. طاقته ورؤيته للتنمية رائعة. ناقشنا النطاق الكامل للعلاقات بين الهند والإمارات العربية المتحدة بما في ذلك سبل تعزيز العلاقات الثقافية والاقتصادية.@MohamedBinZayed pic.twitter.com/Yom2sKv8Sz

— Narendra Modi (@narendramodi) July 15, 2023

The two countries also signed another agreement, which allows them to link their fast payment systems, namely the Unified Payments Interface (UPI) of India with the Instant Payment Platform (IPP) of the UAE.

The memorandum of understanding for promoting the use of local currencies -- the Indian Rupee (INR) and the UAE Dirham (AED) -- for cross-border transactions, was signed by the governor of the Reserve Bank of India and his counterpart at the Central Bank of the UAE.

Being the first of its kind, the MoU is aimed at establishing a local currency settlement system to promote the bilateral use of the two countries' national currencies. It covers all current account transactions and permitted capital account transactions.

The new settlement system enables Indian and Emirati exporters and importers to invoice and pay in their respective domestic currencies, thus facilitating the development of a foreign exchange market between India and the UAE.

The new development came amid India's efforts to promote cross-border transactions in local currencies and reduce dependence on the US dollar.

This came as the global drive toward de-dollarization rages on unabated amid growing efforts by different countries to ditch dependency on the US dollar and trade with their own national currencies.

US Treasury Secretary Janet Yellen said in the middle of June that Washington should expect a gradual decline in the dollar's share of the global reserve, as the global de-dollarization move gains momentum.

"We should expect over time a gradually increased share of other assets in reserve holdings of countries — a natural desire to diversify," she said.

Yellen acknowledged that the use of sanctions has motivated some countries to look for currency alternatives.

At present, all indicators show that the amount of US dollars held in reserves by non-US central banks has fallen to its lowest level.

The weaponization of the US dollar, in addition to the imposition of US sanctions on perceived adversaries, has made other countries wary of utilizing the greenback in their financial transactions.

As a result, countries such as Iran and Russia are moving towards the elimination of the dollar altogether, while China and other major Asian economies, including India and Malaysia, have declared their support for such de-dollarization projects.

The BRICS group of nations, which includes Brazil, Russia, India, China and South Africa, has also been discussing the development of a BRICS-specific multilateral wallet and currency.

Bahraini mourners hold symbolic funeral procession for late Hezbollah leader

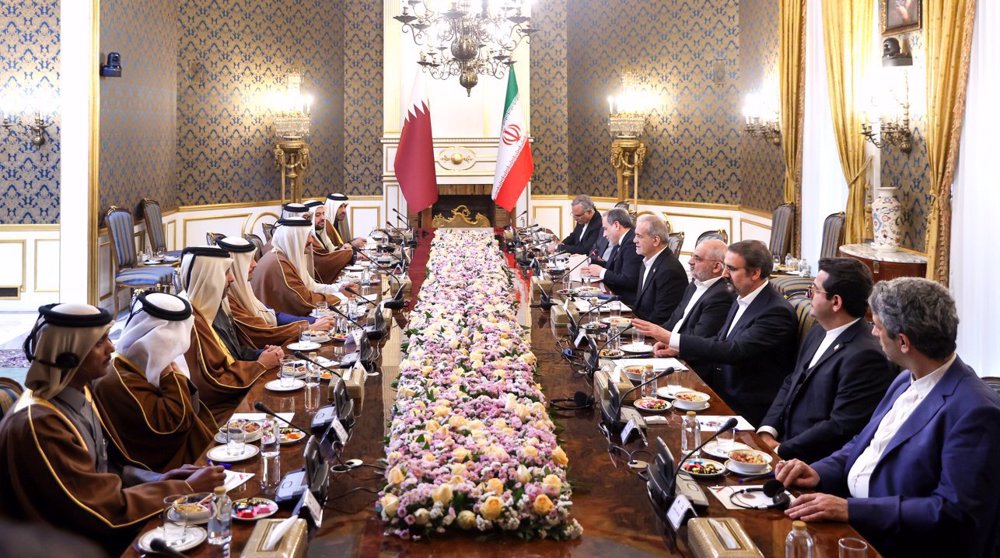

Leader puts premium on boosting ties with neighbors in meeting with Qatari Emir

President Pezeshkian: Iran, Qatar opening new avenues for cooperation

To regain legitimacy, African Union must cut imperialist ties and put Africans first

VIDEO | Iran Army conducts over 160 special operations during Zolfaqar 1403 maneuvers: Cmdr.

Palestinian abductee dies of systematic torture in Israeli Megiddo Prison

US, Europe complicit in Israel’s blocking of Gaza aid: Pro-Palestinian NGO

UN concerned by ‘fundamental shift’ in US policy since Trump returned to power

Hamas hails ‘heroic Haifa operation’ as natural response to Israeli genocide

Arrest of activist Yves Engler and unchecked growth of Zionist network in Canada

VIDEO | Interview with Lawrence Wilkerson

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website