The ongoing global trend toward dedollarization

The US Treasury Secretary, Janet Yellen, says Washington should expect a gradual decline in the dollar share of the global reserve as a global dedollarization move is gaining momentum.

Secretary Yellen made the remarks during a US House Financial Services Committee hearing in response to questions about the risk of de-dollarization fueled by an increase in US sanctions.

Yellen acknowledged that the use of sanctions has motivated some countries to look for currency alternatives.

But isn't it a fact that the use of the dollar has diminished and gone down against competing currencies over the years?

US House Financial Services Committee

There's been some increase in holdings of other reserve assets but that's something to be expected in a growing world economy where we should desire to diversify but ...

US Treasury Secretary, Janet Yellen

So we should expect less for the dollar is what you're saying.

US House Financial Services Committee

We should expect, over time, gradually increased share of other assets in reserve holdings of countries to natural desire to diversify [sic].

US Treasury Secretary, Janet Yellen

However, she claimed, no alternatives exist that could completely displace the greenback claiming that "the dollar is far and away the dominant reserve asset".

Her comments come amid growing efforts by different countries to ditch dependency on the US dollar and to trade with their own national currencies.

Kenya champions the Pan African Payment and Settlement System that is done by our own institution; the Afreximbank.

Why members? Why is it necessary for us to buy things from Djibouti and pay in dollars? Why? And we are not against the US dollar we just want to trade much more freely.

Let us pay in US dollars what we are buying from the US, but what we are buying from Djibouti, let's use local currency.

William Ruto, President of Kenya

All indicators show the amount of US dollars held in reserves by non US Central Banks has fallen to its lowest level.

At the turn of the century roughly 70% of the global currency reserves were in the US dollar; currently it stands at slightly below 60%.

Another important indicator of the accelerated dedollarization efforts is that various countries, including some US allies, have reduced their holdings of US debt to diversify their foreign exchange reserves

The dollar share of global reserves collapsed from 73% in 2001 to just 55% by 2021 before dropping off a cliff after the Russian sanctions dropping eight points to 47% last year.

Peter St. Onge, Economist

The weaponization of the US dollar and Washington's insistence on imposing sanctions on perceived adversaries has made other countries wary of utilizing the greenback in their financial transactions.

Of course, our sanctions are in part enabled by the important role of the dollar and US banks in the financial system. We work whenever possible with other countries...

US Treasury Secretary, Janet Yellen

Shouldn't we be more concerned now in slapping sanctions on countries around the world, and taking that into consideration it'd be more thoughtful as we may be creating a paranoia around the world where people are looking for other currencies to deal with sanctions?

US House Financial Services Committee

It is true that when we impose sanctions on countries that are afraid they can be the subject of those sanctions are motivated to look for other tools other than the dollar to engage in transactions.

US Treasury Secretary, Janet Yellen

The sweeping US sanctions on Russia in the wake of the Russia Ukraine war sent a warning to the rest of the world about the risks of the US using the dollar as a tool for geopolitical gain.

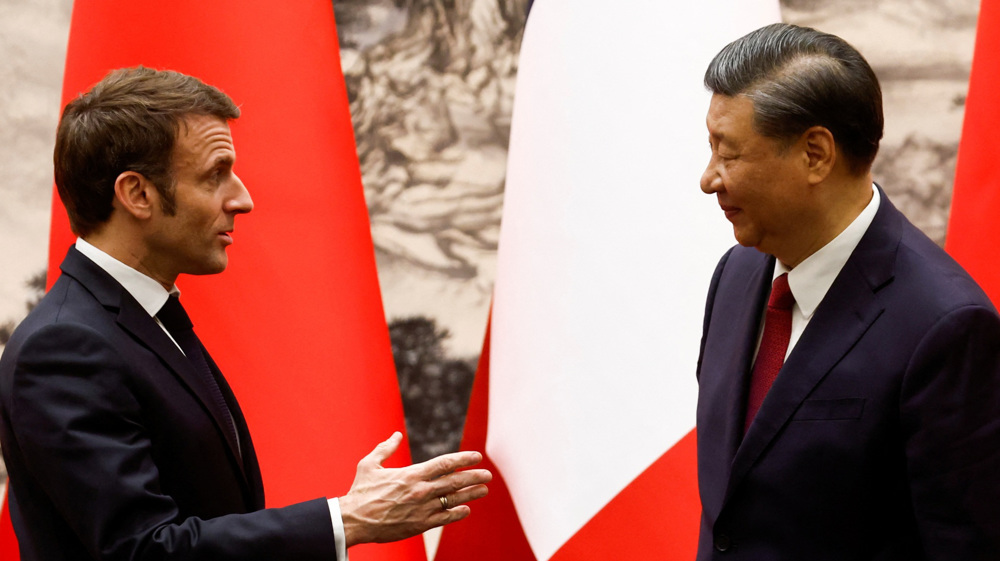

Several countries are looking to move away from their dollar dependence and China is promoting the Yuan as an alternative.

China has become a major rival for the United States, a rivalry that is increasing on many levels.

Just days ago, Pakistan paid for its first shipment of crude oil from Russia in the Chinese Yuan.

In February, the Central Bank of Iraq, a major oil supplier, announced that it would allow trade with China to be settled in the Yuan for the first time.

Members of the China dominated Shanghai Cooperation Organization, the SCO, agreed to increase trade in their local currencies.

Brazil is also leading the call to move away from the dollar. When Brazil's President, Lula da Silva, visited China earlier this year, he blasted the monstrous role of the US dollar in the global economy.

The two nations have forged a recent part to replace the dollar with their own currencies in their trade deals.

Brazil, in our hemisphere, the largest country in the Western Hemisphere, south of us, cut a trade deal with China; they're going to from now on do trade in their own currencies, get right around the dollar.

They're creating a secondary economy in the world totally independent of the United States.

We won't have to talk about sanctions in five years, because there'll be so many countries transacting in currencies other than the dollar that we won't have the ability to sanction them.

Senator Marco Rubio, Senate Foreign Relations Committee

Last year, Saudi Arabia and China announced that officials are in talks to price some of the nation's oil sales in the Yuan rather than the dollar.

Any move to conduct all transactions with China in the yuan will mark a profound shift in the energy market.

The BRICS nations, comprising Brazil, Russia, India, China, and, South Africa, are also poised to achieve a level of self sufficiency in international trade by developing their own currency and ditching the US dollar

5 Israeli forces killed as Palestinian fighters face up to regime’s war machine

VIDEO | Israeli settler killed during strike against Tel Aviv; fresh aggression targets Yemen’s capital

VIDEO | Yemen’s missile strikes on Tel Aviv

Iran to open 6 GW of new power capacity by next summer

VIDEO | South Korean rallies set the stage for battle over Yoon's impeachment

Hamas, other Palestinian groups say Gaza ceasefire deal ‘closer than ever’

VIDEO | Press TV's news headlines

Iran condemns ‘violent’ attack on Christmas market in Germany

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website