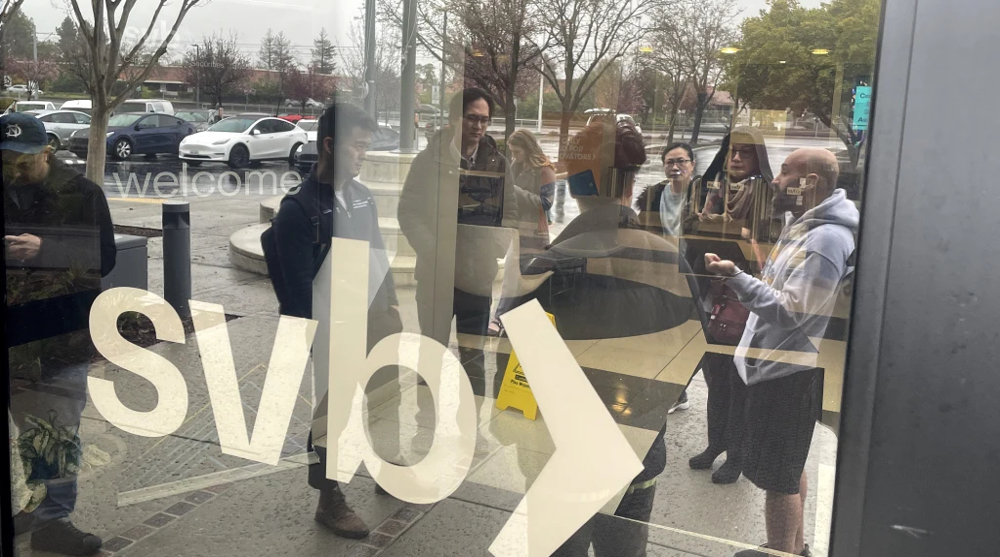

Silicon Valley Bank failure tanks other banks in domino effect

The US has pulled the plug on Silicon Valley Bank in the biggest banking failure in the country since 2008.

The bank, which has been a key lender to US startups since the 1980s, failed after depositors hurried to withdraw money over liquidity concerns.

It is the second-largest failure of a US financial institution in history.

The Silicon Valley Bank held $209 billion in assets at the time of its collapse.

Even after adjusting for inflation by assets, it trailed only Washington Mutual, which held $434 billion in assets when it failed in 2008 during the US home mortgage crisis, which triggered the world financial crisis.

Is the US headed for another financial crisis? What does the failure of this bank say about the state of the US economy?

The SVB failure was triggered by the sale of $1.8 billion in a bond fire sale which led to clients withdrawing their deposits.

SVB is the 16th largest bank in the country, which held $210 billion in assets, at the time of its failure.

What does the $1.8 billion bond fire sale mean?

Well, the bond sale is (because) the bank was short on cash and so (it) went to the bond market to cash in its bonds to get cash. But everybody said wait a minute, why are they short on cash and began looking a little further into the bank's finances but the issue is not the $1.8 billion.

The centrality of this bank is that it is the banker for approximately, according to The New York Times today, 2500 or so startup companies. These companies are high tech companies of all kinds, many of them in California.

And so a company, let's say, is starting up and they're beginning to grow their business, and they're crucial to this little, you know, market that they've got and they have $4 million deposited in this bank and this happens.

Well what does that mean? It means the first $250,000 of their money is okay, but the other three and a half million or 3 million and three quarters is not okay. They can't get to it so they might not be able to make payroll, they might not be able to pay off other, you know, suppliers.

And so what happens here is there is a multiplying effect in a very, very crucial portion of the American economy, which is the high tech startup portion of the American economy.

And that's the importance of this bank.

Professor Frank Emspak, University of Wisconsin

How can the second biggest US bank SVB collapse over $2.25 billion needed to shore up its balance sheet despite having assets worth hundreds of billions?

Yeah, I think Frank is quite right, this is just a very small trigger or spark for something much bigger. I mean, essentially, we never escaped the 2008 financial crisis, because the way to escape that was that people should have lost a lot of money but they didn't and the banking system was propped up.

And money is effectively, in this banking system, is our single point of failure and a failure of the banking system, which dwarfs the real economy causes real disruption in the real economy.

Clive Menzies, Political Economy Researcher & Analyst

And money is the medium through which the plunder and control has been exercised. So in 2008, the bank bailouts and then the TARP relief, and the quantitative easing that has happened ever since have been just the issuance of debt to prop up what is effectively a bankrupt banking system.

And by September 2008, the Fed started to expand its balance sheet because, again, there was a liquidity crisis in the money markets, and this is what we're talking about today. The reason that there is a liquidity crisis is that the way this money expansion has occurred, is through central banks buying back much of the toxic debt which accumulated prior to the 2008 crash, and they have been buying debt instruments ever since.

So the whole house of cards is built on very little value which the central banks have been buying at market value. But the market value in no way reflects the real value of the underlying assets. So what we're talking about with this is like dominoes falling; it is the beginning of something much bigger.

The big banks like Deutsche Bank have been bankrupt, but what's shown on their balance sheet has a value that bears no relationship to reality.

Clive Menzies, Political Economy Researcher & Analyst

Yet they don't close down. One would think that the 2008 financial crisis would have taught everyone a good lesson. So where is the SEC, where is the control?

It's not a small bank and the controls are basically, the ideology of control is not to control capitalism, but to support it. And so when there is a banking crisis or liquidity crisis caused by other reasons, in this case, an attempt to curb inflation by raising interest rates and increasing unemployment. You know, that's the chosen method.

And so that creates all kinds of other problems, one of which is that now people can't get cheap money for investment. And so there are questions about the kind of investments that are being made, in this case, 2500 of them in the high tech industry.

So the importance of this bank isn't, isn't alone that money sort of seems to disappear. The importance is that a major innovative, growing, sector of the American economy just got hit in the head because these companies, these smaller companies do not have resources, they can't suddenly go someplace else if their money is tied up in litigation, and get other cash so soon.

So what you've done here is destabilize a very, very important section of the economy, and we don't know this is Saturday, so we don't know what's going to happen Monday, in terms of many of these firms or other banks.

Professor Frank Emspak, University of Wisconsin

SVB served as one of the primary regional banks for the tech sector, servicing numerous startups.

From the latter half of the year 2022, roughly around September, we saw mass layoffs.

When it comes to tech firms, like Meta, Amazon, Google and the likes, the number of layoffs was huge.

And even now in the first quarter of 2023, we have already seen around 50,000 additional employees laid off.

There are multiple strands to this and I think just before I address the tech issues specifically, the tech companies that Frank was describing, what are classified as small to medium sized enterprises. I mentioned in my last contribution just now that the Fed started expanding its balance sheet in September 2019. And that data is quite important, because the COVID psychological operation, as I would call it, was actually instrumental in closing down huge swathes of the small to medium enterprise economy.

So not only is the tech sector being affected by this specific banking crisis, but there has been a general assault on any small businesses and these large companies, the ones that that are laying off masses of people, meta, Microsoft, etc. There are multiple factors at play there because they are losing the ground, to some extent, to distributed autonomous organization, which I might go into later if we have time, which is basically a much more distributed way of working. And they recognize that with AI and all the rest of it, they just don't need the people.

And this economy is built on the premise of [sic] we price labor in terms of supply and demand, but we have an oversupply of labor and a lack of demand because, basically, the more labor you can shed, the more money you make, and that's the sort of cold hard reality of how these companies work. And it's a shareholder value.

So there are many strands, but in essence Frank is right that it's a domino effect that these small companies can't pay their wages, they have suppliers and it goes on down the chain. And this is against the back drop of over inflation or over inflated money supply, which is going to lead to hyperinflation.

So you have all these forces, some of which are opposing, some of which are congruent, and it's going to create a great deal of instability, but luckily there are other things emerging that are going to hopefully act as a safety net when everything, for want of a better way of putting it, excuse my terminology, goes to sh@@.

Clive Menzies, Political Economy Researcher & Analyst

There have been around 125,000 – 200,000 layoffs in a span of about five or six months, particularly in the tech sector, isn't that going to affect the US economy?

When you have that many layoffs, doesn't it adversely affect the US economy, the supply chains, and, the consumers who are now out of the economic cycle, and will no longer be spending any money?

Well, not quite, it might but here's a couple of different things; first of all, 200,000 people out of the tech sector is not a huge amount, given all the people in the tech sector. The second thing is we're not talking about an immediate cut off of income. Many of these people have various packages for unemployment and separation from their company that last a couple of months.

But the importance of this bank failure, that's another issue because a lot of the people in some of these companies went over or are going over to the increase in employment in the smaller and medium sized companies which was fueled by the cheap money. So in a place like Silicon Valley, where there's hundreds of these companies as well as the larger ones, there was a safety valve. And that safety valve now may be closed, because these companies are in trouble.

So that's one thing. I know that but there are countervailing forces if we take this area, Madison, Wisconsin, which is a very, very highly concentrated, medical high tech community. Epic Systems just announced that they were going to hire 1800 more people on top of the 7000 they've got here in the suburbs of Madison. So, you know, there are still different sectors of the economy that are growing.

And of course, we now have what's going to be another infusion in the tried way in which the United States has dealt with unemployment and whatnot, the Keynesian method of defense spending. There is a four point something percent increase in the defense spending, there are increasing demands and cries to the defense industry to hire people to supply the war in Ukraine. And so there's going to be a big push in that direction.

So I think there are some countervailing forces. Now we'll see if there are enough, but the fact of the matter is that the area that's going to be most affected is going to be this high tech sector, about a quarter of a million people, although it sounds like a lot, and it's certainly not good news, is not the kind of thing that will destabilize the economy.

What's going to destabilize the economy is if a couple of these other banks that are related in the same economic sector as this bank, if they begin to falter on Monday, then we're in a different situation.

Professor Frank Emspak, University of Wisconsin

Given the $1.5 trillion that was spent on Covid19 and the return that the US is getting, considering the US GDP, it's not getting that much of a return. Isn't that indicative of a US economy that's not on a steady footing?

Well, I think that presupposes that American policy had anything to do with bank bailouts and COVID and all the rest of it, that was all driven by the people who are beneficiaries of all the debt that is being created. I mean, the banking system is driving everything, the people who control money, so, no; they didn't get much of a return.

But, you know, nor did anyone else. And what we're talking about is a structural issue, we have, we have some fundamental flaws in our structure, and there is no way out of this other than to change the structure as to how we organize ourselves.

And then what underpins that structure is money, which I described as a single point of failure, and what is emerging to take its place is a very different way of handling value, which is already being capitalized on by Amazon, Google,... because they're using our data and they are making huge amounts of money out of it.

What is going to shift is that instead of having that data value harnessed and harvested by relatively few small companies, which cumulatively, Apple, Amazon and, I think, Google, are worth something like 15 trillion. That is going to dissipate into something called distributed autonomous organization. Open source created the internet, and it is creating the same environment for money or value. It's yet to be applied to money but it will be, money methodology, will change and that is the way the transition will occur.

But the existing framework of continually creating more and more debt in order to keep this bicycle upright, sooner or later fails, that's why we have debt jubilees and bank failures every few decades. And, arguably, we had the mother of all bank failures in 2008.

What they're desperately trying to do with the great reset and all the other measures they are trying to do is come up with a digital replacement, to try and anaesthetize the economy from all this debt, but it “ain't gonna work”. And so, this distributed autonomous organization is what will emerge to take its place.

Clive Menzies, Political Economy Researcher & Analyst

You said we have to wait until Monday to see how other banks are doing. Isn't that a worrying sign that we have to wait?

There are two different interpretations of this. One take is that contagion is going to happen and other banks are sure to either go bankrupt or stop operations.

Another take is that banks are in a good financial standing so that's not going to happen.

So where do we stand?

Well, I think it partially depends on the bank and your business. And I don't have, you know, in my head (an) encyclopedic knowledge of all these major banks. All right, I think that it stands, yes it's worrisome the fact that you were sitting around on Saturday, and you've got 2500 small businesses who desperately tried to move their money from the Silicon Valley Bank to other banks so they can operate on Monday morning.

You know, they are the ones who are worried and, of course, observing this and reading the tales of woe in the paper about this and that company who had millions of dollars, now they can't get it. Of course, it's worrying. And yes, it's disturbing that you should have the most powerful economic system in the world waiting for 24 hours to see if there's going to be a collapse. So obviously, there's a problem. The fundamental problems, though, are that start you know, a whole trend.

When the Federal Reserve says, well, we're going to solve inflation by attacking working people by increasing employment and raising interest. Well, what do you think is going to happen? What's going to happen is that money available to startups is going to become more expensive, and they're going to be looking around for other ways to deal with it. And so you begin to undermine that industry. And that's what's happened here.

They began to go to the SVG saying we need more cash. SVG is looking around so well. Alright, we are short, sell the bonds and oh my god, why are you short on cash? What's going on over there? And so you have these contradictory effects. Yes, we put in a tremendous amount of money, the American government put in one point something trillion dollars, to what, to a social safety net fundamentally, that had been underfunded for a quarter of a century.

And so what we did is we reached the minimum standard that most people in the developed world had for 18 months, incidentally, it's all gone away now.

So we're not talking about an investment in productive efforts in this business. You know, we're talking about making good on a quarter of a century of unpaid debt, in a certain sense, to people. Now, now, just now in the last year or so, Biden and his advisors (say) jeez, we got to we got to do something; we're losing the productivity battle.

So these things are all happening at once, and I think (they) are mutually contradictory and hence, very, very difficult of solution.

Professor Frank Emspak, University of Wisconsin

The Fed released a job report that indicates there are lots of jobs that have been filled despite all the layoff, how is that possible?

Briefly, because there's a much bigger explanation but in essence, as I've said before, money rules and the banking system comprises central banks and commercial banks and they create all the money, they created all the debt, and they run the financial system and by running the financial system, they run all the other levers of power.

Governments do not rule, the money system has access to all the roots of power, including government, but commerce. ... as far as the other piece of Frank's conversation about what was going to happen on Monday and he said it depends on the state of the balance sheet and the business type of the other banks.

In essence, banking is a confidence trick. Basically, you sign a piece of paper for a loan, and they give you money in return. And as long as everybody has confidence in that bank, then that money is regarded as being worthwhile. And so the confidence trick is their business model. And thus, if you lose confidence, then the trick fails, and we have a banking collapse. And this is the SVB situation.

I cannot predict whether on Monday, the dominoes are going to continue falling, because I've been staggered given that we saw this coming in 2015, I've been staggered at how long they've managed to perpetuate this tightrope walk, if you like, and they've not yet finished.

Clive Menzies, Political Economy Researcher & Analyst

Are you saying there'll be other banks that may default?

Well, I don't know, I'm not making a prediction, but I know for a fact that most of the major banks are bankrupt because their balance sheets comprise assets, which have been marked to value because the Fed and other central banks have been buying them at market price.

Clive Menzies, Political Economy Researcher & Analyst

VIDEO | Rome, Milan host new protests in solidarity with Palestinians

Dec. 21: ‘Axis of Resistance’ operations against Israeli occupation

Spain jurists demand ties with Israel ties be cut

VIDEO | Press TV's news headlines

VIDEO | Iran honors top Science Olympiad medalists

VIDEO | Austrians arrested at Gaza protest in Vienna

10 killed in bus crash in western Iran

VIDEO | One-man-band journalism with Civili

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website