Yellen warns about 'catastrophe' if Congress fails to raise debt limit

US Treasury Secretary Janet Yellen has once again warned about a financial “catastrophe” if Congress fails to agree on raising the debt ceiling.

Yellen said on Monday that “every responsible member of Congress” must agree to raise the debt ceiling — the amount of money Washington can borrow to pay its bills on time.

The US reached its borrowing limit of around $31.4 trillion in January.

Raising or suspending the debt ceiling allows the Treasury Department to pay expenses already approved by Congresses and presidents. The department is now taking “extraordinary measures” to continue paying bills on time.

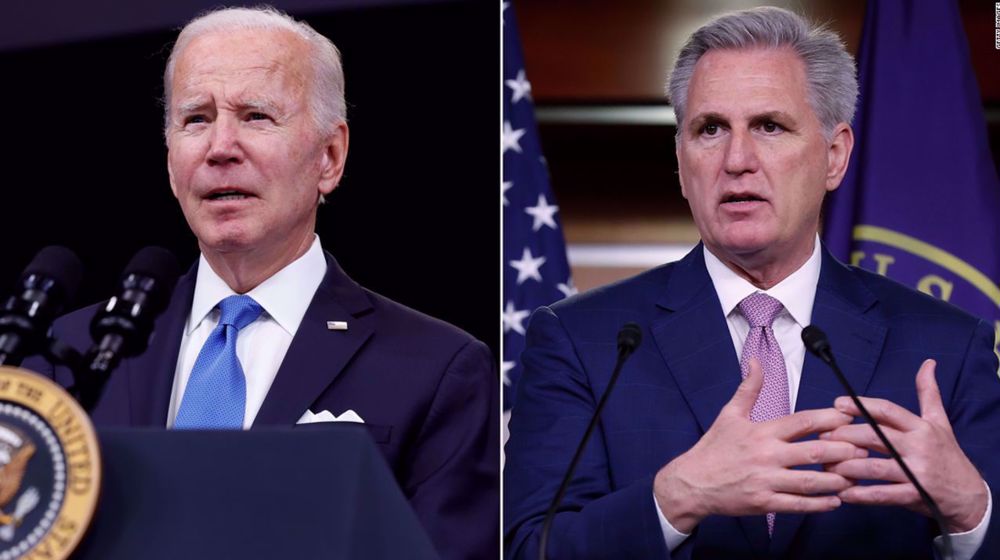

The White House and many Democrats are pushing to raise the borrowing limit quickly, while Republicans are pressing for spending cuts as a condition to raising the ceiling.

“America has paid all of its bills on time since 1789, and not to do so would produce an economic and financial catastrophe, and every responsible member of Congress must agree to raise the debt ceiling,” Yellen told ABC News.

Yellen has been implementing a set of “extraordinary measures” to maneuver funds and help the government pay its bills until sometime this summer, but the country can’t take on any new debt to pay what it owes until Congress lifts or suspends the debt ceiling.

The Treasury secretary has already warned that the country could tip into a deep recession if lawmakers don’t take action on the borrowing limit.

Yellen, however, said on Monday that the US economy is “remaining strong” as inflation appears to cool.

“You don’t have a recession when you have 500,000 jobs and the lowest unemployment rate in more than 50 years. What I see is a path in which inflation is declining significantly, and the economy is remaining strong,” she said.

Yellen also warned about a “global financial crisis” if there is no debt limit agreement.

The CEO of Bank of America (BAC), America’s second-largest bank, also said America is still at risk of a “mild recession” at some point in the future.

Speaking to CNN, Brian Moynihan said he hopes lawmakers resolve their differences, because the market and economy love stability.

If Congress doesn't raise the debt ceiling, the government could default on its debt. But a default is much more than Washington simply not paying its debt. It would greatly impact the economy and people thorough the country.

A default would increase interest rates, which would then increase prices and contribute to inflation, analysts say.

D-8’s role in Iran’s economy after Cairo summit

China slams US as ‘war-addicted’ threat to global security

China ‘firmly opposes’ US military aid to Taiwan

VIDEO | Press TV's News Headlines

President Yoon Suk Yeol to be removed from office

At least 19 Gazans killed by Israeli airstrikes since dawn: Medics

Leader: Iran neither has nor needs proxy forces

US fighter aircraft shot down ‘in friendly fire’ amid aggression on Yemen

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website