Japan's inflation hits 40-year high amid weakening yen, soaring energy costs

Japan's inflation surged by 3.6 percent in October from the previous year, marking a 40-year high, amid weakening yen and soaring energy prices, the government said in a report on Friday.

The government data showed the nationwide core consumer price index (CPI), which excludes volatile fresh food prices but includes energy, rose for the 14th straight month, beating a 3.5 percent increase forecast by economists.

The Asian country last saw the same level in February 1982, according to Refinitiv data.

The soaring inflation also crossed the Bank of Japan’s (BOJ) two percent inflation target for a seventh straight month, as the Japanese currency saw a historic fall in 32 years, hitting 151 yen to the US dollar.

“It is getting harder for the BOJ to keep saying that the current cost-push inflation is temporary,” Mari Iwashita, chief market economist at Daiwa Securities, was quoted as saying. “If the yen remains weak, more companies will try to pass on costs to consumers.”

The BOJ confirmed that it would not join the global trend of tightening monetary policy through rate hikes, despite broadening price pressures, keeping long-term interest rates around zero and short-term rates at minus 0.1 percent.

"I haven't changed my view that the rise will start to slow down soon," said Takeshi Minami, chief economist at Norinchukin Research Institute, noting the decline in global grain prices. "I expect inflation to peak by year-end and the rise in prices to start diminishing in the new year."

The BOJ governor, Haruhiko Kuroda, on Thursday again called for maintaining monetary stimulus to support the country's fragile economy.

Kuroda has repeatedly stated that the current above-target inflation is unsustainable and largely driven by import costs of global commodity prices and the weaker currency.

Japan's consumer inflation would likely reach 3 percent for the current fiscal year-end to next March, but the pace would fall to half that rate next year as the commodity and other cost-push factors run their course, Kuroda said.

Last month, Japanese prime minister Fumio Kishida revealed a 260 billion dollar stimulus package aimed at reviving the economy, as the government seeks to curb the negative impacts of rising prices on households and businesses.

By driving down the value of the yen, the BOJ's policy has certainly profited overseas Japanese firms but has contributed to the rise in the costs of imported goods.

The economy that is still recovering from the COVID-19 pandemic has grown concerns for households as energy prices are expected to rise further with rising demand as the harsh winter approaches.

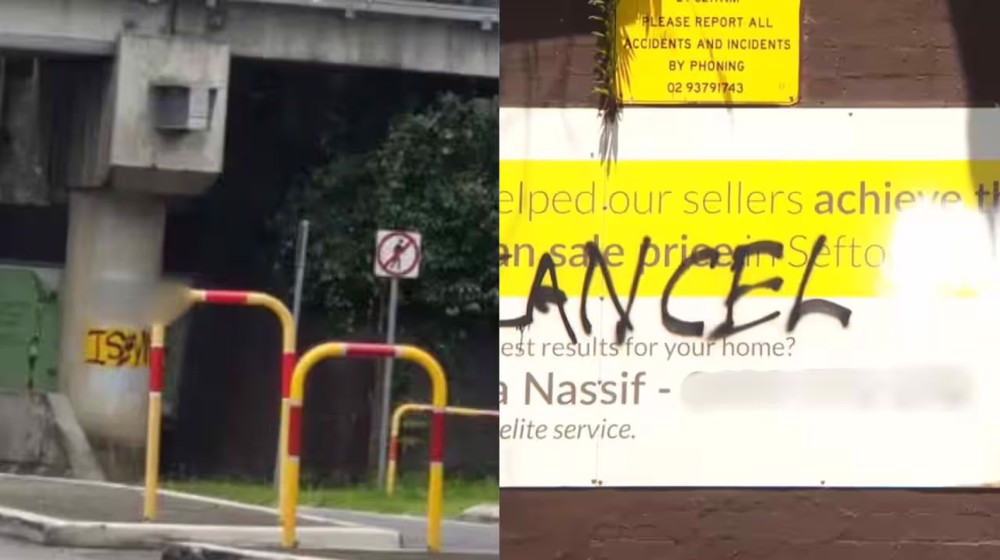

VIDEO | Australians rally for Gaza ahead of Christmas festivities

VIDEO | Attacks on Sana'a

Iran reports further drop in annual inflation rate in December

Israel indicts two settlers over suspected spying for Hezbollah

Iran: US airstrikes on Yemen war crimes, violation of international law

Yemeni armed forces down F-18 fighter jet, repel US-UK attack: Spokesman

Iran warns against US-Israeli plot to weaken Muslims, dominate region

VIDEO | Public uproar in US against Israeli regime

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website