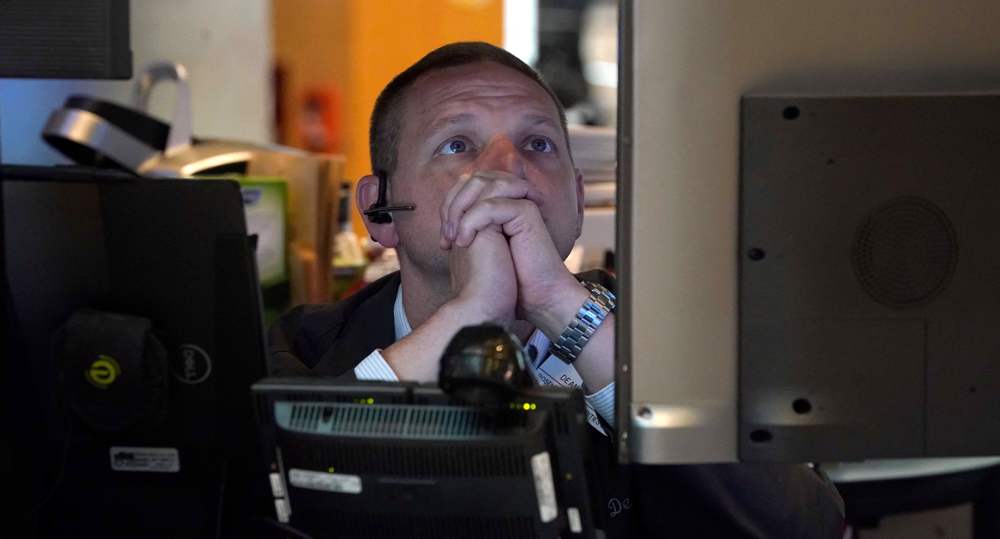

US inflation rising at record rate

Inflation has been on the rise in the United States, hitting a four decade high of more than nine percent, leaving many Americans with no choice but to dig deeper into their finances just to pay for gasoline, food, healthcare and rent.

Recent surveys have found that three out of four middle-class Americans feel that their income cannot keep up with soaring inflation. Most Americans are preparing for a recession by cutting back on spending, delaying major purchases, or planning to work longer before retirement.

How badly are the soaring prices affecting the ordinary American? Will things get worse when the country, as expected, enters into a recession? And who is to blame for this situation? Is it “Putin’s prices hike”, mismanagement by the administration, or could it perhaps be a bit of both?

Data published by the Department of Labor shows that the United States is experiencing its largest increase in consumer prices since 1981.

Annual food prices are rising at their fastest pace since then, with energy prices posting their largest jump in more than 42 years.

Public Opinion

Prices are up a lot; the basics like eggs, milk and you go to the fruit aisle or the fresh vegetable aisle, there's nothing left for less than like $3 or $4 per pound or for whatever, peaches are a dollar each, it's kind of crazy.

Elderly Male Shopper

Of course, we've all noticed mostly at the gas pump. So I just filled our Volvo SUV up and it's quite expensive. So I've noticed that that's mostly what I've noticed and of course in the supermarket, those two places.

Male Shopper

I mean, this is this is something that is on everyone's mind. But if you look at surveys, whether it's with Harvard or with Pew, this is this is inflation is the number one topic for customers today. And we're well aware of that.

Sales Representative

New vehicle and home prices maintain their upward trend as do used cars and trucks and apartment rentals.

Why are we seeing such soaring prices and what keeps them so high?

Well, inflation is high because there is a rising demand for things, for consumer goods, but there is not sufficient supply and so the prices are rising as a result.

And there has been pent up demand as a result of the kind of loosening of the economic restrictions connected to the pandemic and there are supply chain bottlenecks, particularly around microchips and, and the like.

And so that is those are the main reasons of course, there's also very low unemployment, so people are employed, they have money and so they are, with this money, chasing after fewer and fewer goods. So that's why the prices go up.

John Feffer, Institute for Foreign Policy Studies

During the COVID 19 pandemic the Federal Reserve allowed interest rates to drop to nearly zero as the economy came to a complete halt.

Workers were left unemployed as many businesses closed.

In order to aid companies and individuals in adjusting to the resultant economic shock the government spent trillions of dollars on stimulus measures.

Once the economy was restarted, coming out of lockdowns and restrictions imposed for the pandemic, many Americans started to eat, shop and travel, the market simply could not cope with the situation.

How likely is it for prices to come down in the near term?

Inflation is rising now because 100 trillion dollars of money has been created over the last 100 years, and this is not just in the US, but these are actual bank balances of money that's been created.

And many people have been waiting and wondering when are we going to have inflation? You know, Milton Friedman and the monetary people said we should have had massive inflation, but velocity has remained low until this period of time.

And now it's starting to pick up because people have inflationary expectations.

Todd Boyle, Certified Public Accountant, Retired

Gas prices are at record highs. When fuel prices go up consumers are not only hurt directly at the pump, but also indirectly when higher transportation costs raise prices on everything from food to diapers to construction materials.

Since the beginning of the Ukraine War, Russia has been selling less oil because of sanctions imposed by the European Union, the United States and other major economies.

This has reduced global supplies and led to a jump in prices. US officials have tried to blame Russia for the rise in fuel prices, and consequently for the general rise in consumer prices, calling it “Vladimir Putin's price hike”.

Oh well that's ridiculous because inflation is a monetary phenomenon and the size of the global economy is so huge that it's quite, you know, well understood by securities analysts.

Unfortunately, ordinary people can't maneuver as easily as they can. But yeah, the war in Ukraine caused some shortages of petroleum and natural gas.

And so these are drawing from the US and causing less supply in the US and causing the gasoline prices to go up for ordinary Americans. But no, it's not, inflation is not caused by the war in Ukraine, It's probably caused more by COVID-19.

This particular explosion in inflation was already well underway before the war in Ukraine.

Todd Boyle, Certified Public Accountant

According to a recent survey, over 60% of Americans blamed the Biden administration for the currently soaring inflation. The mandate of the US Central Bank is to promote employment and keep inflation in check, mostly by raising and lowering short term interest rates. The Fed has already increased interest rates three times this year.

The survey reveals that 56% of Americans are concerned that the federal interest rate hikes will cost them their jobs this year, while 80% believe that they are already heading into a recession.

That very same view is shared by many experts who believe US economy is indeed moving toward a recession.

Recessions inevitably come along. It's just a question of how severe those recessions are.

And of course, the Biden administration would like to ensure that, whatever recession comes along, and whenever it comes along, that it is relatively mild, but the reasons for the recession are, the economic indicators suggest that economic growth is not robust, that inflation is high, and that there might be a kind of spiral downward and that that might result in a couple of quarters in a row of depressed economic activity, which would suggest a recession.

John Feffer, Foreign Policy in Focus, Institute for Foreign Policy Studies

For many, the recession is already present; unemployment has been through bouts of turbulence with millions of people losing their jobs because of the COVID-19 pandemic. US unemployment is at a historic low.

Millions of Americans who retired or quit during the pandemic, a phenomenon now known as The Great Resignation, have yet to return to the labor force while firms are struggling to find workers.

Well, we have a very interesting thing you could call a recession, but there's no shortage of jobs available. Unemployment is very low.

So what you have is millions of people have left the labor force. Of course, tens of millions of people were forced out of the labor force by COVID and the shutdown of various industries, you know, particularly in the jobs that didn't pay very well in the first place were the ones that were pushed out, but what we have now is a great resignation.

And this is no joke. A lot of people now live simpler lives, have enough material resources to do that.

Todd Boyle, Certified Public Accountant

This low economic growth will certainly have more downsides for some groups than others. During the pandemic, the rich managed to dramatically increase their wealth, while the poor and the middle class lost more money.

Who will bear the brunt of a recession and how badly will it affect the poor and those living off food stamps?

Well, you know, obviously, the burden falls more heavily on poor Americans who are struggling to make ends meet, struggling to pay their bills, with rising prices for rent and essential commodities. It is difficult.

Now, as I said, there's relatively low unemployment so people are able to get jobs but often they have to have more than one job, they have to work long hours in order to make the same kind of salary that they made previously.

A recession would be challenging, especially if that recession was accompanied by significant unemployment, if companies began to lay off their employees, or reduce their work force in other ways, that would make it really hard for working Americans.

John Feffer, Foreign Policy in Focus, Institute for Foreign Policy Studies

Historically, recessions almost always hit lower wage workers the hardest. A recent poll shows that 44% of US adults say that they don't believe they're financially ready if a recession hits.

Part of that concern may be due to people's current financial situation. Many people say that they either don't have enough money, or have just enough money, to cover their basic expenses.

The things that go up too high we actually have to take them off the menu, because there's just no way it can stay on a menu and we sell these things to our customers.

We will have to skim a lot and we'd like for everything that we do to taste the same, to have that same authentic love so, even in that, we won't be able to have our (regular menu until the prices go down).

American Restaurateur

I think each day is a new day. We're not really sure what's going to happen in the business or in the economy when we wake up in the morning.

So we just take each day as it comes and try to adjust and make the most of however the situation presents itself to us.

American Businessman

It has come out that 58% of American workers worry that their paycheck is simply not enough to support them and their families. Financial anxiety is especially strong among Hispanic workers and parents with small children, and as a result of these concerns, 28% of adults plan to search for a new, and presumably better paying, job within the next six months.

Millennials and Generation Z adults are far more likely to seek out higher paying jobs, 40% and 36% respectively.

Elders who are on the lower amounts of Social Security, they're just being displaced in large numbers, living in their cars and stuff. And all the older people are talking about this.

But the ones who had savings or who had paid off their houses before they retired, they're very comfortable. And the same is true for younger people, there are some people who are going to be very comfortable, and because they have resources.

There's a huge number of Americans who have trust funds from their parents, you know, or inherited something from their parents.

And so they will not be suffering, but the people who are just living from month to month paycheck to paycheck will and do (suffer).

Todd Boyle, Certified Public Accountant

The approval ratings for US President Joe Biden are at record lows; with Americans holding him responsible for what many economists believe will be a punishing recession.

Even before the pandemic, nearly two out of three US residents did not have enough savings to cover a surprise $500 expense. The Biden administration has a crucial midterm election ahead.

Officials are cognizant that any drastic measures in the short term will badly affect the chances of the Democrats in the elections.

What would the recovery from such a punishing recession entail?

Well, the recovery would be modest to robust economic growth and a return to historically low unemployment rates, which is where we're at the moment, a greater confidence in the economy and therefore greater willingness to make big purchases, buying houses, buying cars and so forth.

So that is pretty much what a recovery would look like. It would look more or less what the economy looked like coming out of the economic lockdowns associated with the COVID pandemic.

Again, greater confidence that the future and the economic future in the United States is rosy and that people can spend money without worrying that they're going to be in economic difficulties one month, two months, or one year down the line.

John Feffer, Foreign Policy in Focus, Institute for Foreign Policy Studies

Many economists say that in order to tame high inflation, it is inevitable for a country to enter a recession.

Many would not buy into such" blame justifications" such as “Putin’s price hike” on the part of the US government. And there is all this talk of a looming recession; just another blame game.

Is there really no way to stave off a recession?

Well, I mean, certainly a recession is one way of dealing with high prices. If your overall economic activity declines then, of course, prices are going to tumble as well.

But there are, I would say less, less harsh methods of reining in inflation and making credit a little tighter, which is of course what the Federal Reserve does, ensuring that there is greater supply available of key commodities, in other words, dealing with supply chain problems, ramping up production, in other respects, in other areas.

All of that can make supply greater and therefore, prices falling [sic] accordingly. I think the latter strategy is perhaps a less challenging way of dealing with inflation in a way that doesn't put the burden on working Americans.

John Feffer, Foreign Policy in Focus, Institute for Foreign Policy Studies

Advocates for aggressively attacking inflation assert that rising prices are the greatest risk facing the economy, and that failing to tame inflation now could bring about catastrophic conditions.

Many also agree that the economy can absorb a slowdown because so many indicators, particularly unemployment, are so strong right now.

Others say that tackling inflation will mean imposing some real harm, but argue that the pain will only become more severe, the longer policymakers wait to act.

Is it worth risking a recession to get inflation under control?

In terms of inflation, or excess demand, the authorities always have the choice of exactly who to reduce their access to money.

In other words, should they increase taxes on the rich to reduce aggregate demand, increase taxes on corporations, or will they just increase interest rates and prevent ordinary people from being able to afford to buy a house or a car?

And so the historical record is clear that they always take money away from the little guy or the middle class. They don't take money away from the wealthy classes.

Todd Boyle, Certified Public Accountant

There seems to be no short term solution to the rising inflation in the United States. The government is also concerned about the midterm elections and a vote that is a good opportunity for Republicans to dethrone Democrats from the United States Congress.

Joe Biden's public approval rating fell to 36% earlier this month, the lowest rating in his 90 months in the White House.

His approval rating is now the worst of any elected president at this point in his presidency since the end of the Second World War.

Many factors are driving this overall feeling of dissatisfaction among Americans. But inflation is arguably the biggest reason.

D-8’s role in Iran’s economy after Cairo summit

China slams US as ‘war-addicted’ threat to global security

China ‘firmly opposes’ US military aid to Taiwan

VIDEO | Press TV's News Headlines

President Yoon Suk Yeol to be removed from office

At least 19 Gazans killed by Israeli airstrikes since dawn: Medics

Leader: Iran neither has nor needs proxy forces

US fighter aircraft shot down ‘in friendly fire’ amid aggression on Yemen

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website