Official sees Iran’s oil output surpassing 4 million bpd in new year

Iran’s vision for the new Persian year of 1401 which began Monday is to ramp up crude oil production above 4 million barrels per day, CEO of the National Iranian Oil Company (NIOC) Mohsen Khojastehmehr says.

The focus will be on developing West Karoun, home to a cluster of oilfields which Iran shares with Iraq, to raise production to 1 million bpd, he was quoted as saying during a tour of the region on Tuesday.

Since 2013, oil production from the block has increased six-fold to 420,000 bpd, Iranian media reports have said.

For additional development, $12 billion of investment is initially required in West Karoun, including $8 billion for shared fields, Khojastehmehr said.

Straddling the border with Iraq, West Karoun includes several large oilfields, namely Azadegan, Yaran, Yadavaran, Darkhovin, Naftshahr, Paidar-e Gharb and Azar, with the first three divided into north and south projects. The block holds an estimated 67 billion barrels of oil in place.

Khojastehmehr said NIOC’s plan is to accelerate development of South Azadegan and conclude the $4 billion investment scheme for the second phase of Yadavaran.

The plan includes integrated development of North and South Azadegan which requires some $7.5 billion of investment.

“Our priority is development and maximum production of shared fields,” he said. “Our vision for 1401 is to increase production capacity, which we hope to reach over 4 million barrels per day.”

The Azadegan field is Iran’s largest, estimated to contain 5.7 billion barrels of crude reserves. For development, Iran has divided the field into North and South Azadegan.

China National Petroleum Corp (CNPC) brought online the first phase of North Azadegan with 75,000 barrels per day (bpd) of output in November 2016. Last December, Khojastehmehr said Iran was negotiating development of the second phase of the field with foreign companies which he did not identify.

NIOC officials in the past have said the second phase of North Azadegan was being considered for development under a new contract model and CNPC was interested.

The development of South Azadegan is being carried out by a domestic company under a contract worth $5.6 billion.

Khojastehmehr said there are no restrictions on foreign companies’ investment, but the priority is to use domestic companies.

Another priority in West Karoun is to process natural gas extracted at oilfields and stop flaring it. Khojastehmehr said all the associated gas at North and South Azadegan and Yadavaran fields and part of Darkhovin will be captured and processed in the next six months.

Last month, NIOC signed $1.35 billion of deals to process natural gas extracted at its oilfields and develop an oilfield in the resource-rich Khuzestan province.

About $500 million of the deals involved building facilities to capture gas from East Karoun fields, Minister of Petroleum Javad Owji said then, adding the Persian Gulf Holding Company would sign similar contracts soon to collect gas from West Karoun fields.

Oil producing countries often burn or flare a certain amount of natural gas that accompanies crude oil to the surface which is too small to be recovered or pipelined to a processing facility. The phenomenon, however, emits hazardous air pollutants during the flaring of the associated gas.

Former Minister of Petroleum Bijan Zangeneh had once said that Iran needed $5 billion in investment to stop flaring gas at its oilfields.

Last week, Owji said his ministry planned to raise production capacity of crude and condensates in the new current year to 5.7 million bpd from about 3.7-4 million bpd.

In televised remarks, he also said he would try to raise Iran's oil and condensates exports to 1.4 million bpd as set out in an annual state budget.

In May, his ministry put Iran’s condensate production north of 550,000 bpd which it expected to rise to 1.3 million bpd by the end of the Persian year on March 20.

Despite decades of sanctions and limited investment, Iran remains one of the 10 largest oil producers in the world, ranking eighth after the US, Saudi Arabia, Russia, Canada, Iraq, China and the United Arab Emirates.

The country sits on the world’s fourth-largest proven oil reserves after Venezuela, Saudi Arabia and Canada. It also accounts for 17% of global gas reserves and ranking second after Russia.

Iran is the third-largest gas producer after the US and Russia, accounting for 6.5% of the global gas production, though most of it is consumed locally.

The market is desperately looking for Iranian oil as it braces for a major supply shock caused by the Ukraine conflict, namely the potential loss of nearly 5 million bpd of Russian oil exports.

Losing this volume of oil would leave a big hole to fill, but energy analysts say any additional supplies from Iran would ease some of the pressure in an extremely tight market and soothe nerves.

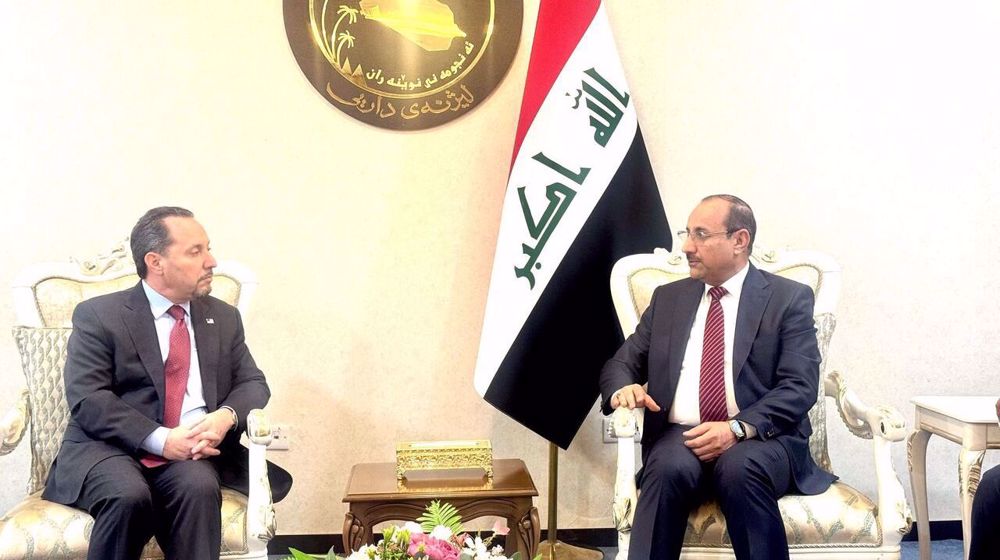

Iraq warns US its power grid would collapse without Iran gas supplies

Role of world’s largest gas field in Iran’s energy security

Trump admin. revokes Iraq’s sanctions waiver for Iranian electricity imports

Iran Armed Forces ready to give 'crushing response' to aggressors: Army commander

VIDEO | American exceptionalism & Trump's foreign policy with Peter Kuznik

Fake plan to attack Australia synagogue fabricated by organized crime: Police

‘Attack on free speech’: Condemnations as US threatens to deport pro-Palestine activists

VIDEO | Russian, Chinese naval vessels enter Iranian waters for major joint military drills

Iran condemns deadly violence in Syria against minority groups, urges end to massacre

Houthi calls Takfiris in Syria tools of foreign powers amid ‘genocide’, warns of consequences

Canada’s next PM: We cannot let Trump and his trade war win

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website