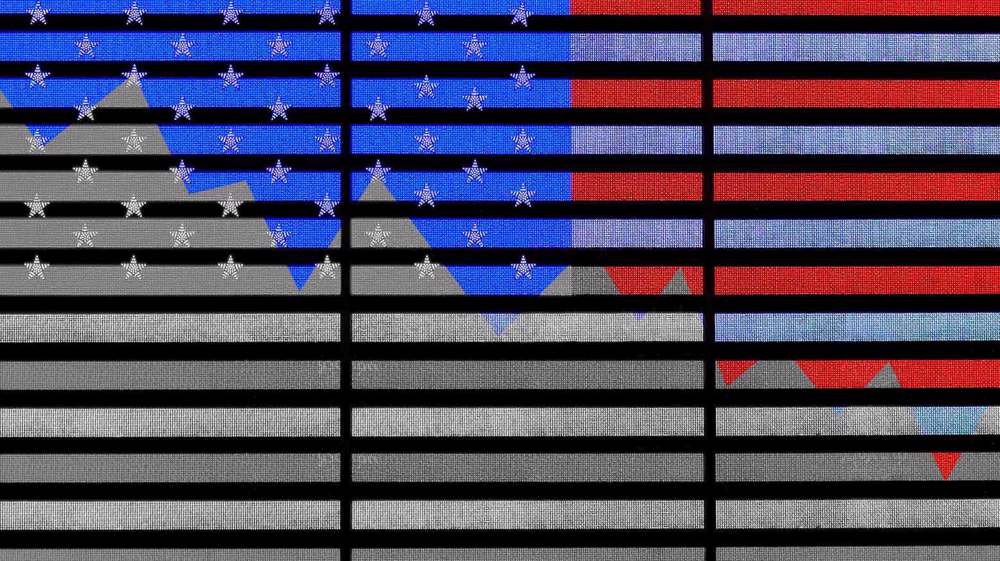

US has slipped into recession as bad as 2007-08 meltdown, study finds

The US has already slipped into a recession that could be as bad as 2007-08 meltdown, according to a new research that punctures holes in media reports about booming stock market and low unemployment.

David Blanchflower, former member of the Bank of England Monetary Policy Committee, and Alex Bryson, a University College London professor, in a new research claim that the US has already entered recession in late 2021.

The indices are drawn from questions asked from ordinary Americans about their income expectations, employment conditions and what they expect for the US economy in the near future.

“We show consumer expectations indices from both The Conference Board and the University of Michigan predict economic downturns up to 18 months in advance in the United States, both at national and at state-level,” the authors note in the report.

They argue that gross domestic product (GDP) growth figures are artificially high and that unemployment numbers have been twisted by furlough schemes.

“The economic situation in 2021 is exceptional, however, since unprecedented direct government intervention in the labor market through furlough-type arrangements has enabled employment rates and unemployment rates to recover quickly from the huge downturn in 2020,” reads the report.

The single monthly jump of at least 0.3 percentage points in the unemployment rate, the report says, also predicts recession, as does two consecutive months of employment rate declines.

The data, it notes, are “relatively timely” and published a few months after the month they relate to, while the GDP data gives a clear picture year later after the data have been a long revision process.

The authors argue that consumer data shouldn’t be ignored, pointing to magnitude of drops in consumer confidence in 2021 in eight states — California, Florida, Illinois, Michigan, New York, Ohio, Pennsylvania and Texas — which is comparable to the declines recorded in 2007.

“It seems to us that there is every likelihood that the US is entered recession at the end of 2021. The most compelling evidence is from the Conference Board expectations data for the eight biggest states,” the report notes.

“The size of the declines by state is comparable to those in 2007 prior to the Great Recession. Indeed, for the US as a whole the most recent drop is larger (25 in 2007 versus 19 in 2007),” it adds.

In conclusion, Blanchflower and Bryson say there is a possibility that these data are giving a “false steer”, but “missing the declines in these variables in 2007, as most policymakers and economists did, proved fatal.”

The financial crisis of 2007–2008, also known as the global financial crisis, was a worldwide economic crisis. Before the Covid-19 recession in 2020, it was considered by the most serious financial crisis since the Great Depression.

“It is our hope such mistakes will not be repeated this time around. They missed it last time, hopefully they won't miss it this time. These qualitative data trends need to be taken seriously,” the report adds.

Earlier this month, the US Treasury Secretary Janet Yellen said she believes the economy would fall into a recession if Congress fails to raise or suspend the debt limit before the country defaults on trillions of dollars of debt.

“I do regard Oct. 18 as a deadline. It would be catastrophic to not pay the government’s bills, for us to be in a position where we lack the resources to pay the government’s bills,” Yellen said in an interview.

“I fully expect it would cause a recession as well,” Yellen added, a day after US President Joe Biden accused Senate Republicans of taking a "reckless" position in refusing to join Democrats in voting to raise the government's $28.4 trillion (28,400 billion) debt limit.

Congress has so far failed to raise America’s $28.4 trillion debt ceiling amid a standoff between Democrats and Republicans, who have refused to support raising or suspending the current ceiling.

VIDEO | Press TV's news headlines

Iran ready to strengthen ties with UAE based on ‘mutual interests’: Deputy FM

VIDEO | A slap in the face of imperialism

Iran remains steadfast in its ‘principled positions,’ says Foreign Ministry

VIDEO | Holding on to hope: Gazans welcome Ramadan despite hardship

VIDEO | Kirk, veteran war journalist

VIDEO | 'Fras Market turned into wasteland'

Trump, Vance rebuke Zelensky in heated Oval Office confrontation

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website