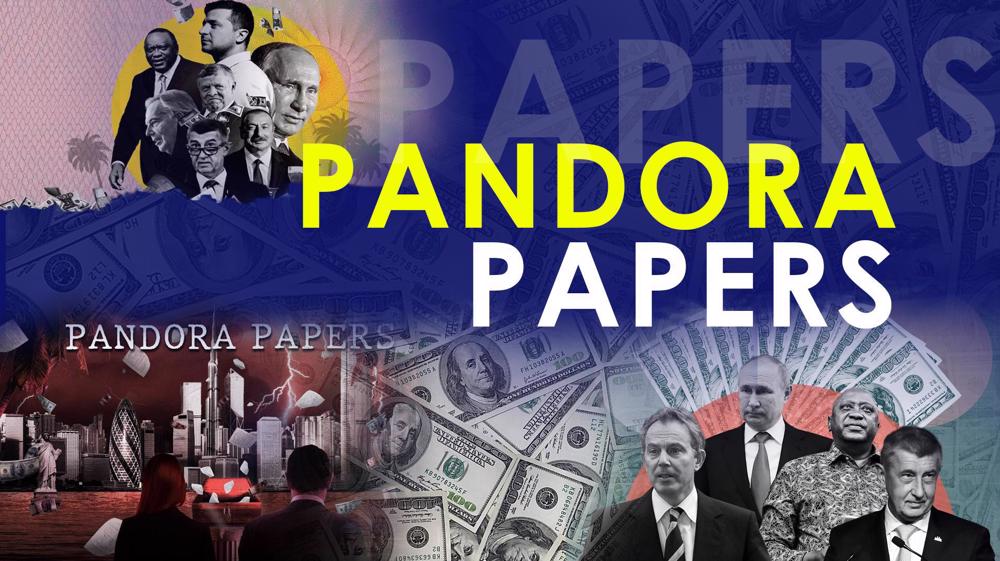

The Pandora Papers reveal high level global corruption

The biggest ever data leak in history has exposed hidden offshore assets worth millions of dollars allegedly linked to 35 current and former world leaders, and more than 300 other public officials from over 90 countries.

Nearly three terabytes of data was dumped in "the Pandora papers" and leaked to the Washington based International Consortium of Investigative Journalists.

Over 600 journalists help review 12 million documents leaked from 14 financial services companies. Jordan's King Abdullah, a close US ally, was reported to have used offshore accounts to spend more than $100 million on luxury homes in the United Kingdom and the United States.

The expose also implicated the family and close associates of Azerbaijani President, Ilham Aliyev, of corruption, suggesting that they have traded close to £400 million in UK property over the past 15 years through a network of offshore firms.

The papers have also implicated the Czech Prime Minister, President of Ukraine, Cyprus, Kenya, and former British Prime Minister, Tony Blair, among other high profile figures.

The problem of tax havens has not been solved because people don't want to solve it. It's very simple. First of all, bear in mind the central banks around the globe have opened up their money spigots to extraordinary levels since the 2008 financial crisis.

So as a result you have tons and tons and tons of capital circulating around the world, unregulated, looking for the highest profit levels, etc. And the banking sectors are making lots and lots of money over this.

Daniel Lazare, Author and Journalist

While having offshore firms and accounts isn't illegal, the Pandora Papers allege that some of the companies have helped officials hide their wealth, practically enabling them to evade paying taxes, while some others have used them for money laundering and other fraudulent financial schemes.

According to the Pandora papers over a dozen US states are providing financial secrecy services that rival those of offshore tax havens in Europe and the Caribbean region.

The documents single out South Dakota, which has allegedly sheltered billions of dollars in assets linked to people previously accused of financial crimes. The investigation revealed South Dakota State lawmakers have adopted lax regulations drafted by trust industry insiders, measures that have quadrupled customers trust in this state, compared to 10 years ago.

Some of the trusts cited in the probe are linked to people accused of human rights and labor abuses.

The revelations come despite President Joe Biden's pledge that Washington will lead efforts internationally to promote financial transparency and fight against corruption.

Now the US, for example, talks about equalising tax rates, shutting down tax havens, etc, etc. But in fact, individual US states have been opening their doors wider and wider to these kinds of activities. South Dakota is one example, Nevada is another, and a third is Delaware, a small state on the East Coast, which is home to Joe Biden and Joe Biden is essentially is a product of this, anything goes, hot money, corporate culture.

Daniel Lazare, Author and Journalist

The rich and powerful people cited in the large scale investigation have already begun to deny wrongdoings and have, in some cases, expressed readiness to undergo scrutiny. One thing that is certain is that they will have a lot to answer for in their respective countries for months or even years to come.

Yemeni armed forces down F-18 fighter jet, repel US-UK attack: Spokesman

Iran warns against US-Israeli plot to weaken Muslims, dominate region

VIDEO | Public uproar in US against Israeli regime

‘Ghost town’: 70% of Jabalia buildings destroyed by Israel

Mother’s Day: Sareh Javanmardi’s inspiring journey as Paralympic champion and mother

Russia downs over 40 Ukrainian drones as Putin vows 'destruction' on Kiev

VIDEO | Yemen: A bone in Israeli neck

D-8’s role in Iran’s economy after Cairo summit

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website