Lebanon government accuses central bank of breaking law by removing fuel subsides

Caretaker PM Hassan Diab says Lebanon’s central bank has violated the law by eliminating fuel subsidies, adding the damage will dwarf the benefits of preserving the mandatory reserves, which the bank is trying to protect.

The small Mediterranean country has since 2019 been paralyzed by a major financial crisis, which has cut the value of its currency by more than 90 percent, eliminated jobs, and made banks freeze accounts.

Since the onset of the crisis, which has thrown more than half the population into poverty, the central bank has been effectively subsidizing fuel by using its dollar reserves to fund imports at exchange rates far less than the rates on the parallel market.

The decision, however, has drained the mandatory reserve, as the fuel subsidy has been costing some $3 billion a year. The central bank's reserves have shrunk from over $40 billion in 2016 to $15 billion in March.

Late Wednesday, Riad Salameh, the governor of Lebanon's central bank, announced that the bank would no longer subsidize the fuel.

On Thursday, Diab attacked Salameh’s decision on Twitter, calling it a unilateral move that would have critical consequences as the Arab country struggles with a persisting and crippling financial meltdown.

“It is a decision that contravenes the law," the caretaker premier said, referring to the June law establishing the prepaid cards.

“Its damages are much greater than the gains of protecting the mandatory reserves in the central bank” because it would take the country into the unknown, Diab warned, stressing that he was opposed to subsidies being removed before an alternative was on offer.

President Michel Aoun, for his part, summoned Salameh to the presidential palace for a meeting, during which the governor refused to reverse the decision, arguing that the use of the mandatory reserve required legislation, an unnamed ministerial source said.

The central bank says while it has spent over $800 million on fuel in July alone and the bill for medicines has multiplied, those goods are still absent from the open market, and that they are being sold at prices that surpass their value.

“This proves the necessity of moving from subsidizing commodities, which benefits traders and monopolists, to supporting citizens directly,” the bank said.

According to a schedule reported by a Lebanese broadcaster on Wednesday, the price of 95 octane gasoline, without subsidies, is projected at over four times its previous price.

Separately on Thursday, Lebanon’s oil directorate announced in a statement that fuel prices were issued a day earlier still apply and are binding on companies and gas stations.

It added that fuel prices being circulated by media were not accurate and were based on mere assumptions.

Walid Jumblatt, who is a leading Lebanese Druze politician, for his part on Thursday backed the decision by the central bank, saying the fuel subsidies must be removed.

“There is no escape from removing subsidies because the supply is going to Syria,” he said in a televised press conference. “If we continue with subsidies, not one penny of the obligatory reserve will remain, and that will be the catastrophe,” he added.

Furthermore, a ministerial source told Reuters that the Lebanese caretaker government would discuss a law later on Thursday allowing the central bank to use its mandatory reserve to continue subsidizing fuel imports.

Hezbollah rejects central bank move

Hezbollah dismissed the central bank’s decision to eliminate fuel subsidies, stressing that such a move contravenes policies being pursued by the government and parliament.

The lawmakers, in a statement issued after their weekly meeting, called for the rollout of the prepaid cash card for the poor before any other move to cut or reduce subsidies on any essential goods.

Hezbollah leaders’ historic funeral showed resistance strength: Islamic Jihad

Nasrallah, Safieddine symbols of 'graceful resistance': Iran's Foreign Ministry spokesman

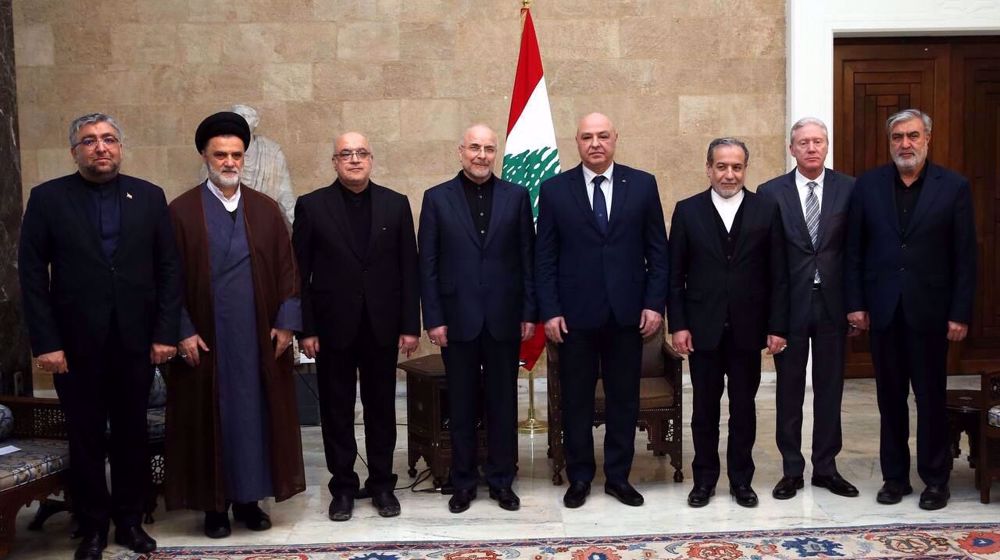

Lebanese president reaffirms support for Palestine as he meets Iranian officials

Shocking details of Israeli army’s massacre of 90 civilians from Juha family in Gaza

VIDEO | Lebanese resistance remains alive

Iran’s daily sweet gas production peaks at 870 mcm: NIGC

Nasrallah shattered myth of Israeli military’s invincibility: Top Yemeni official

Iran says it has attracted $8.2bn of foreign investment since Aug

‘Misguided policies’: Araghchi says unjust sanctions inflict suffering on innocent Iranians

Iran summons Polish envoy over 'baseless, biased' drone claims

Election winner conservative Merz invites Netanyahu to Germany despite ICC warrant

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website