US renews waiver for Iraq to continue Iran trade

The Trump administration says it is extending a 90-day waiver for the second time to let Iraq continue energy imports from Iran which is under draconian US sanctions.

The State Department issued the waiver after the original exemption granted in December 2017 expired on March 19.

"While this waiver is intended to help Iraq mitigate energy shortages, we continue to discuss our Iran-related sanctions with our partners in Iraq," a State Department official was quoted as saying.

The waiver will allow Iraq to continue buying gas and electricity from Iran.

Gas imports from Iran generate as much as 45 percent of Iraq's 14,000 megawatts of electricity consumed daily. Iran transmits another 1,000 megawatts directly, making itself an indispensable energy source for its Arab neighbor.

Iraq and Iran share a 1,400-kilometer-long border. For their run-of-the-mill maintenance, Iraqis depend on Iranian companies for everything from food to machinery, electricity, natural gas, fruits and vegetables.

The State Department said on Tuesday Washington was continuing to work with Iraq to end its dependence on Iranian gas and electricity and to achieve energy independence.

Iraq, however, is pushing back on US pressures in what has become a major point of conflict between Washington and Baghdad, the New York Times reported in February.

According to the leading newspaper, the Trump administration had told Iraq’s leaders that they had until late March to end electricity purchases.

The US gave a 45-day waiver on electricity to Iraq and extended it by 90 days in December after it reimposed sanctions on Iran in May.

Officials in Baghdad say there is no easy substitute because it would take three years or more to adequately build up Iraq’s energy infrastructure, the paper reported.

Iraqi officials say the American demand acknowledges neither Iraq’s energy needs nor the complex relations between Baghdad and Tehran.

Iraq’s former prime minister Haider al-Abadi has told the New York Times that Baghdad was in a precarious situation because the Americans have failed to “look at the geopolitics of Iraq.”

“We happen to be neighbors of Iran; the US is not. We happen to have the longest border with Iran; the US does not. And we don’t have that powerful an economy,” he said.

Iraq’s infrastructure has been destroyed in 30 years of wars, mostly after the US invasion which saw the bulk of the highly-skilled human force leave the country.

Iran offers an invaluable pool of human capital, services and resources which are literally within a walking distance from the Iraqi border.

Hence, choking such a vital source is as much damaging - if not worse - to Iraq as it is to Iran, explaining why President Barham Salih said recently that Iraq’s interests lie in maintaining very good relations with Iran.

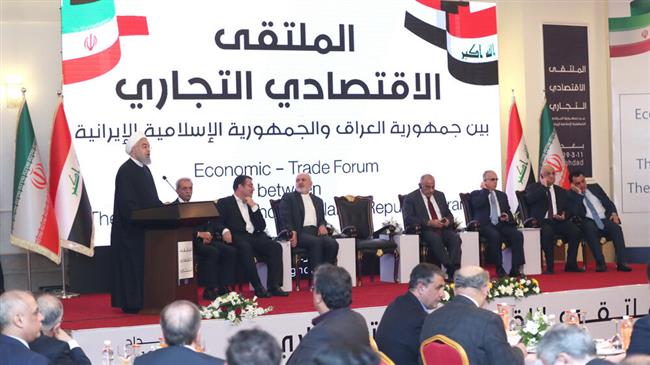

His remarks came as President Hassan Rouhani visited Iraq about a week ago with a delegation of 32 businesspeople and oversaw the signing of several deals in oil, healthcare, bilateral commerce, and a railway linking the two countries.

Iraqi leaders, including Prime Minister Adil Abdul-Mahdi, have stressed that Baghdad will not be a party to the system of sanctions against Iran.

Observers say the new deals will convince Tehran that Baghdad is serious about its pledge. They will also make it all but impossible for the White House to refuse to exempt Baghdad from its sanctions on Iran.

“The futility of US pressure on Iraq over Iran should serve as a fresh reminder of the fundamentally questionable nature of Trump’s one-dimensional and confrontational Iran policy,” former University of Tehran and Boston University professor Kaveh Afrasiabi wrote.

“This effort to demonize Tehran as a force of subversion with respect to its neighbors flies in the face of the opposite reality: the increasingly powerful and mutually beneficial relations between Iran and Iraq,” he added.

During Rouhani’s visit, officials said the two countries were set to further boost the already flowering trade which has jumped from an annual $2 billion eight years ago to over $12 billion today, and is expected to rise to $20 billion in two years.

‘All wars have rules. All of those rules have been broken’ by Israel

VIDEO | Report flags India’s violation of rights of Rohingya detainees

Turkey's foreign minister meets Syria's de facto leader in Damascus

'Next to impossible' to rescue patients from Gaza's Kamal Adwan Hospital: Director

VIDEO | Vietnam current prosperity

Report blames gasoil exports for shortage at Iranian power plants

VIDEO | Hind Rajab Foundation names Israeli war criminals vacationing after Gaza genocide

VIDEO | Australians rally for Gaza ahead of Christmas festivities

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website