Beijing, Tokyo to exchange national currencies against backdrop of US trade war

Japan and China have signed a currency swap agreement as part of a larger plan to wean their financial sectors of the US dollar against a backdrop of trade friction with Washington.

The arrangement which is set to last until 2021 will pave the way for both sides’ central banks to exchange local currencies up to 200 billion yuan or 3.4 trillion yen. ($30bn)

"The Bank of Japan is prepared to provide liquidity in the yuan currency, if Japanese financial institutions face unexpected difficulties in yuan settlements and if the bank judges the liquidity provision to be necessary for ensuring the stability of Japan’s financial system,” a statement by BOJ said.

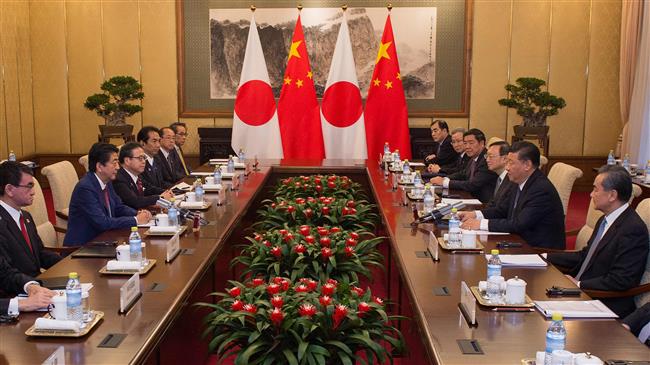

It was signed during the visit of Japan’s Prime Minister Shinzo Abe to Beijing for talks with Chinese officials.The three-day visit, which is the first by a Japanese premier since December 2011, comes shortly after the 40th anniversary of the Treaty of Peace and Friendship between the world’s second and third economies.

During the visit, the two sides also signed several agreements on strengthening bilateral ties in various areas including finance and trade.

China has seriously sought to use its national currency in mutual trade settlements with partners as part of a larger plan to bypassing the US dollar in the past months.

A similar trend is witnessed among other countries like Russia, China, Japan, Iran, Turkey, Venezuela, and others which are facing the US economic wars. The governments of these countries have recently called for weaning their financial sectors off the US dollar, warning that the dollar monopoly could have dangerous consequences for world’s economy.

UNRWA warns of humanitarian collapse in Gaza

'Hello my enemies': Lebanese journalist on Israeli threats and his resolve to continue

Outrage in France as MP proposes bill to ban criticism of Israel

VIDEO | The strategy of Hezbollah in war

Israeli military withdraws several brigades from southern Lebanon: Report

48-year-old Palestinian man serving 48 life terms completes 22 years in Israeli jails

From MKO to Tondar, how Germany became safe haven for anti-Iran terror groups

Hamas open to any proposal aiming to end Gaza war: Hamdan

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website