Protest against Republican tax bill breaks out in US cities

Thousands of protesters have carried out demonstrations in major US cities to express their anger over the narrowly passed Republican tax bill that will offer huge tax cuts for US corporations and the wealthiest Americans.

Individuals of all ages and demographics marched on Monday in Chicago's financial district, where clusters of banks, trusts, and other upper class Americans work.

The protesters carried signs and chanted for equality and for Republican senators to be held accountable for approving the sweeping tax overhaul.

They said the tax bill will make significant cuts to government-sponsored medical insurance and provides large tax breaks for some of the wealthiest people in the country.

"It's a political genocide," Beverley Kirks told Xinhua.

"They're giving a lot of breaks to the upper class and they're screwing over the working people," Rafael Solis told the official Chinese news agency.

Many Chicago residents see this tax reform as shamelessly benefiting wealthy Americans, in spite of US President Donald Trump’s pledge to help the middle class.

"The tax bill is a betrayal of America. It's not acting in the common good," a long-time resident of Chicago said.

Protesters say they will continue to demonstrate against the tax legislation in the coming months in the hope of making a change.

Similar demonstrations were held in several major cities, including Los Angeles, California, and Boston, Massachusetts.

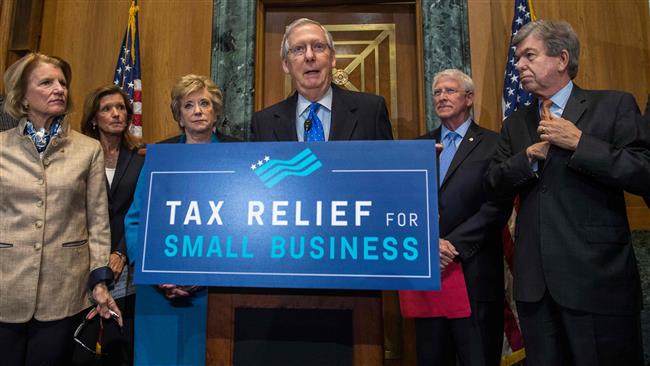

The US Senate in Congress voted 51 to 49 on Saturday in favor of the nation's largest tax overhaul in 31 years, delivering Trump and his fellow Republicans a major legislative victory.

The Senate version of the bill and one passed earlier this month by the House of Representatives must now be reconciled into a single bill, and approved again by both chambers.

The single bill must then go to the White House, where Trump was expected to sign it into law before the end of the year.

Under the bill, the corporate tax rate would be permanently slashed to 20 percent from 35 percent, while future foreign profits of US-based firms would be largely exempted from tax.

The broad-based US tax cuts proposed by the Trump administration in September would mostly benefit the very wealthy while adding $2.4 trillion to the budget deficit over 10 years, according to an analysis by the Tax Policy Center.

The White House Council of Economic Advisers promises that the corporate tax cuts would boost the US economy and offset the deficit.

But the Joint Committee on Taxation, a committee of the US Congress, said Thursday the tax overhaul would add $1 trillion to the deficit, even after accounting for expected economic growth from the plan.

VIDEO | Thousands evacuated in Ethiopia amid earthquakes, volcanic eruption fears

Revealed: Israeli ministers eye restoration of illegal settlements in Gaza through genocide

How Los Angeles’ pistachio tycoons facilitated and profited from wildfires

Iraqi PM: Iran was in Syria to fight terrorism; presence requested by Damascus

Hamas: Israel's massacre in Jenin camp won’t break resistance

60 bodies recovered from abandoned South African gold mine: Police

Biden administration ‘quietly’ circumnavigating own ban on TikTok: Report

Iran Navy takes delivery of first advanced ‘signals-intelligence’ destroyer

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website