Iran’s foreign trade incomes see slump in Q1: CBI

Latest figures by the Central Bank of Iran (CBI) reveal that foreign trade incomes stood at just over USD 30 billion in the first quarter of the Iranian calendar year (started March 21).

The CBI data released on Monday show the volume of foreign trade shrank by some $10 billion in the Q1 to halt at $30.582 billion from 40.302 billion in the same period last year, Tasim news agency reported.

$10.633 billion out of the country’s $17.68 billion exports came from foreign sales of oil and related products such as natural gas and gas condensates. The figure for the same period last year was $17.508 billion, which shows a drop of some seven billion dollars in oil revenues.

The drop comes amid a languishing oil slump on the global market, coupled with anti-Iran sanctions that await removal sometime next month following Tehran’s July agreement with permanent UN Security Council members plus Germany over Iranian nuclear activities.

Iranian media reported on Saturday that the price of the country’s heavy crude oil had plunged to below $30 per barrel for the first time in almost 20 years.

Iran is preparing to raise output by 500,000 barrels per day (bpd) once sanctions are lifted in order to boost market share. Once OPEC’s second biggest exporter, Iran saw its crude sales more than halve to around one million bpd after 2011.

Latest CBI figures, though, put the Q1 oil production at 3.093 million barrels – a 2.6% rise from the same period last year. Yet, crude exports were trimmed down to 1.422 million bpd, which translates into a decline of 0.4% compared to the same period last year.

Foreign Debt

The Central Bank of Iran also said foreign debts experienced a hike of 376 million dollars in the first quarter of the Iranian calendar year to reach $5.484 billion.

The number was $5.108 billion in the same period last year.

The Central Bank also put the unemployment rate in the nation of 78.8 million at 10.8%.

Iran has over the past few years made significant efforts to boost its economy through different measures.

Officials have on occasions spoken of plans to attract some USD 70 billion in foreign direct investment (FDI) only in petrochemical sectors by 2025.

Also, Iran’s Petroleum Ministry recently unveiled new contracts with better incentives than the previous buy-back deal in order to lure foreign investors.

Iran reports surge in air traffic as Austrian, Lufthansa resume flights

Iran money supply up 28.4% y/y in late January: CBI

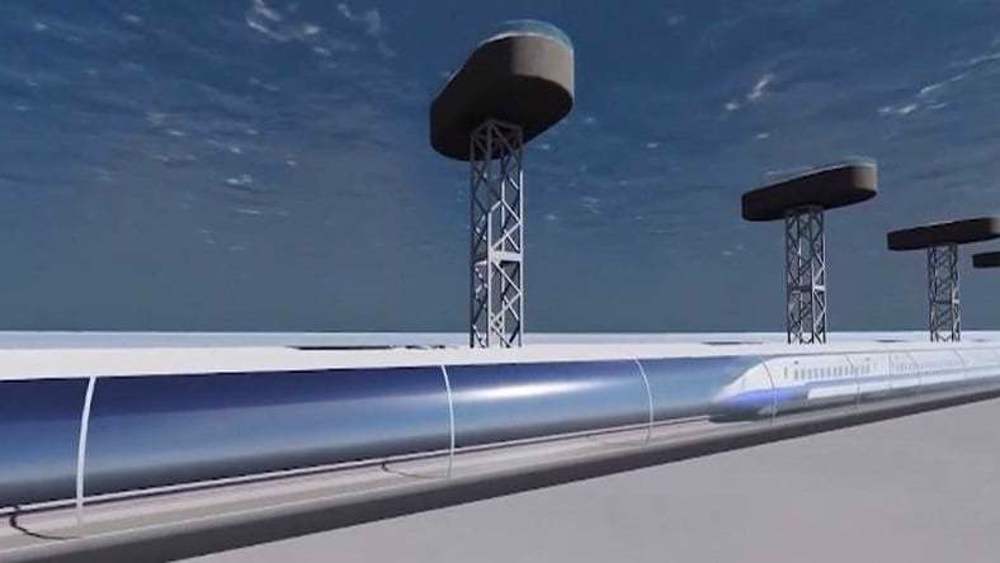

The world’s longest tunnel between Iran and Qatar

Russian consulate in France comes under attack on Ukraine war anniversary

Mourners throng funeral for martyred Hezbollah leader Safieddine in south Lebanon

‘Grave threat’: Iran says Israel’s nukes endangering world, blasts US nuclear spending spree

VIDEO | Global tributes pour in as Beirut mourns martyred Hezbollah leaders Nasrallah and Safieddine

‘We are in the covenant’: Hezbollah leaders' funeral becomes a rallying cry for resistance

EU imposes new sanctions on Russia on third anniversary of Ukraine war

VIDEO | Iran puts advanced jet into operation for first time during major joint drills

Iraq warns Syria over security threats posed by Daesh remnants

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website